Asked by Stacey Floyd on Apr 24, 2024

Verified

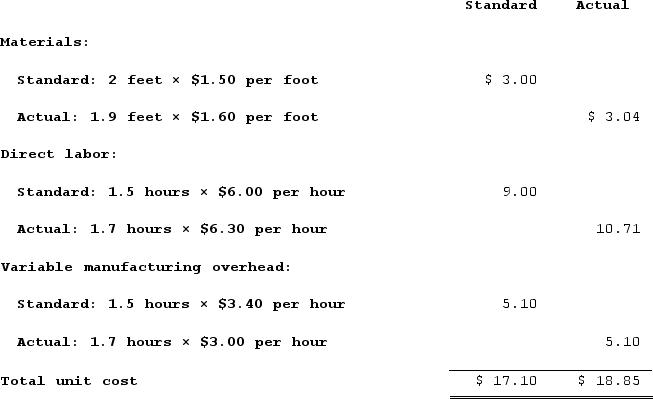

Lido Company's standard and actual costs per unit for the most recent period, during which 500 units were actually produced, are given below:

All of the materials purchased during the period were used in production during the period.

All of the materials purchased during the period were used in production during the period.

Required:From the foregoing information, compute the following variances. Indicate whether the variance is favorable (F) or unfavorable (U):a. Material price variance.b. Material quantity variance.c. Labor rate variance.d. Labor efficiency variance.e. Variable overhead rate variance.f. Variable overhead efficiency variance.

Material Price Variance

The difference between the actual cost of materials and the expected (or standard) cost.

Labor Rate Variance

The difference between the actual cost of labor and the expected (or budgeted) cost, based on predetermined rates and actual hours worked.

Variable Overhead Rate Variance

The gap between what was actually spent on variable overhead and what was predicted to be spent, considering the actual activity level.

- Compute differences between real and expected costs of direct materials and direct labor.

- Examine and explain the variances in materials price and quantity.

- Determine and explain variations in direct labor rate and efficiency.

Verified Answer

b. Materials quantity variance = (Actual quantity − Standard quantity) × Standard price= [950 feet − (2 feet per unit × 500 units)] × $1.50 per foot= [950 feet − 1,000 feet] × $1.50 per foot= −50 feet × $1.50 per foot= $75 Favorable

c. Actual direct labor-hours = 1.7 hours per unit × 500 units = 850 hoursLabor rate variance = Actual hours × (Actual rate − Standard rate)= 850 hours × ($6.30 per hour − $6.00 per hour)= 850 hours × ($0.30 per hour)= $255 Unfavorable

d. Labor efficiency variance = (Actual hours − Standard hours) × Standard rate= [850 hours − (1.5 hours per unit × 500 units)] × $6.00 per hour= [850 hours − 750 hours] × $6.00 per hour= [50 hours] × $6.00 per hour= $600 Unfavorable

e. Variable overhead rate variance = Actual hours × (Actual rate − Standard rate)= 850 hours × ($3.00 per hour − $3.40 per hour)= 850 hours × (−$0.40 per hour)= $340 Favorable

f. Variable overhead efficiency variance = (Actual hours − Standard hours) × Standard rate= (850 hours − 750 hours) × $3.40 per hour= (100 hours) × $3.40 per hour= $340 Unfavorable

Learning Objectives

- Compute differences between real and expected costs of direct materials and direct labor.

- Examine and explain the variances in materials price and quantity.

- Determine and explain variations in direct labor rate and efficiency.

Related questions

Becka Incorporated Has Provided the Following Data Concerning One of ...

The Standards for Product G78V Specify 5 ...

Sakelaris Corporation Makes a Product with the Following Standard Costs ...

Creger Corporation, Which Makes Landing Gears, Has Provided the Following ...

The Standards for Product V28 Call for 8 ...