Asked by Audriana Bridley on Apr 25, 2024

Verified

The company's book value per share at the end of Year 2 is closest to:

A) $0.38 per share

B) $8.18 per share

C) $18.08 per share

D) $13.93 per share

Book Value Per Share

A financial measure that divides a company's shareholders' equity by its number of shares outstanding, indicating the accounting value per share.

- Determine and explain the corporation's book value per share.

Verified Answer

AD

Ashly De Leon7 days ago

Final Answer :

D

Explanation :

Book value per share = Common stockholders' equity ÷ Number of common shares outstanding*

= $1,114,000 ÷ 80,000 shares = $13.93 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $400,000 ÷ $5 per share = 80,000 shares

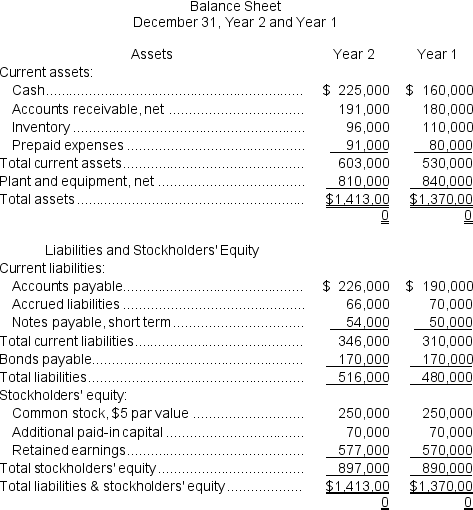

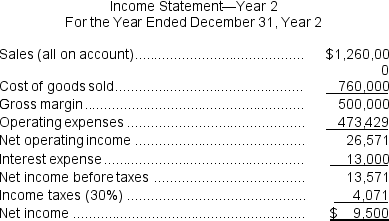

Reference: CH14-Ref27

Symons Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $2,500.The market price of common stock at the end of Year 2 was $2.01 per share.

Dividends on common stock during Year 2 totaled $2,500.The market price of common stock at the end of Year 2 was $2.01 per share.

= $1,114,000 ÷ 80,000 shares = $13.93 per share (rounded)

*Number of common shares outstanding = Common stock ÷ Par value

= $400,000 ÷ $5 per share = 80,000 shares

Reference: CH14-Ref27

Symons Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $2,500.The market price of common stock at the end of Year 2 was $2.01 per share.

Dividends on common stock during Year 2 totaled $2,500.The market price of common stock at the end of Year 2 was $2.01 per share.

Learning Objectives

- Determine and explain the corporation's book value per share.

Related questions

Kisselburg Corporation Has Provided the Following Financial Data ...

Sabino Corporation's Total Common Stock Was $500,000 at the End ...

Jaquez Corporation Has Provided the Following Financial Data ...

Moselle Corporation Has Provided the Following Financial Data ...

Brill Corporation Has Provided the Following Financial Data ...