Asked by Ermina Coronas on Apr 25, 2024

Verified

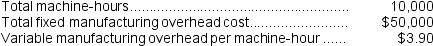

Thrall Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours.The company based its predetermined overhead rate for the current year on the following data:  Recently Job K125 was completed and required 160 machine-hours.

Recently Job K125 was completed and required 160 machine-hours.

Required:

Calculate the amount of overhead applied to Job K125.

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead to individual products or job orders, based on a set formula prior to the start of a period.

Manufacturing Overhead

Indirect costs related to the production process, such as equipment maintenance and factory rent.

- Implement fixed overhead rates to assess manufacturing overhead for individual tasks.

Verified Answer

VH

Virginia Hernandez8 days ago

Final Answer :

Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base)= $50,000 + ($3.90 per machine-hour × 10,000 machine-hours)= $50,000 + $39,000 = $89,000

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $89,000 ÷ 10,000 machine-hours = $8.90 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $8.90 per machine-hour × 160 machine-hours = $1,424

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $89,000 ÷ 10,000 machine-hours = $8.90 per machine-hour

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $8.90 per machine-hour × 160 machine-hours = $1,424

Learning Objectives

- Implement fixed overhead rates to assess manufacturing overhead for individual tasks.

Related questions

Trevigne Corporation Uses a Predetermined Overhead Rate Base on Machine-Hours ...

Session Corporation Uses a Job-Order Costing System with a Single ...

Valvano Corporation Uses a Job-Order Costing System with a Single ...

Baab Corporation Is a Manufacturing Firm That Uses Job-Order Costing ...

Sefcovic Enterprises LLC Recorded the Following Transactions for the Just ...