Asked by Hallie Canto on Apr 26, 2024

Verified

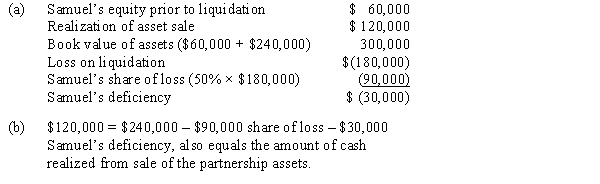

Prior to liquidating their partnership, Samuel and Brian had capital accounts of $60,000 and $240,000, respectively. The partnership assets were sold for $120,000. The partnership had no liabilities. Samuel and Brian share income and losses equally.Required

(a) Determine the amount of Samuel's deficiency.

(b) Determine the amount distributed to Brian, assuming Samuel is unable to satisfy the deficiency.

Liquidating Partnership

The process of terminating a partnership by selling off assets, settling debts, and distributing any remaining assets to the partners.

Capital Accounts

Refers to accounts that show the owners' or shareholders' investments in a business, including retained earnings and contributed capital.

Deficiency

A shortfall or insufficiency in amount or quantity, such as when liabilities exceed assets or when actual performance is less than the standard or expected performance.

- Execute proper accounting procedures during partnership liquidation and understand the effects on partner capital accounts.

Verified Answer

Learning Objectives

- Execute proper accounting procedures during partnership liquidation and understand the effects on partner capital accounts.

Related questions

After Discontinuing the Ordinary Business Operations and Closing the Accounts ...

Prior to Liquidating Their Partnership, Craig and Jenny Had Capital ...

Partners Ken and Macki Each Have a $40,000 Capital Balance ...

In Liquidating a Partnership It Is Necessary to Convert ______________ ...

The HK Partnership Is Liquidated When the Ledger Shows Henson ...