Asked by Christian Rivera on Apr 29, 2024

Verified

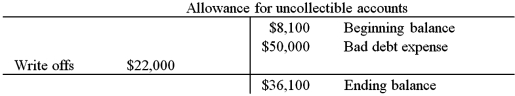

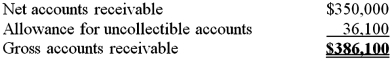

At the close of its third year of operations,on December 31,2014,the Runner Company had receivables of $350,000,which were net of the related allowance for doubtful accounts.During 2014,the company had charges to bad debt expense of $50,000 and wrote off,as uncollectible,accounts receivable of $22,000.Runner had a balance in its allowance for uncollectible accounts at December 31,2013 of $8,100.

Required:

What should the company report on its balance sheet at December 31,2014,as accounts receivable before the allowance for uncollectible accounts?

Allowance for Uncollectible Accounts

A contra-asset account that represents the amount of receivables a company does not expect to collect.

Accounts Receivable

Monies owed to a business by its customers for goods or services delivered or used but not yet paid for.

Bad Debt Expense

An expense recognized by businesses for receivables that are considered uncollectible, reflecting estimated losses.

- Calculate and analyze accounts receivable balances, including the allowance for uncollectible accounts.

Verified Answer

Learning Objectives

- Calculate and analyze accounts receivable balances, including the allowance for uncollectible accounts.

Related questions

The Following Information Is Available for the Bench Company ...

Prepare General Journal Entries to Record the Following Transactions for ...

Describe and Contrast the Procedures for Estimating Uncollectible Accounts Under ...

Describe the Differences in How the Direct Write-Off Method and ...

The Branson Company Uses the Percent of Sales Method of ...