Asked by Gabriel Matar on Apr 30, 2024

Verified

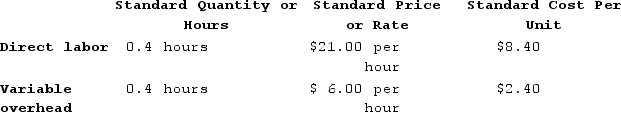

Valera Corporation makes a product with the following standards for labor and variable overhead:  The company budgeted for production of 5,300 units in July, but actual production was 5,400 units. The company used 2,130 direct labor-hours to produce this output. The actual variable overhead rate was $6.10 per hour. The company applies variable overhead on the basis of direct labor-hours.The variable overhead efficiency variance for July is:

The company budgeted for production of 5,300 units in July, but actual production was 5,400 units. The company used 2,130 direct labor-hours to produce this output. The actual variable overhead rate was $6.10 per hour. The company applies variable overhead on the basis of direct labor-hours.The variable overhead efficiency variance for July is:

A) $183 Favorable

B) $180 Unfavorable

C) $180 Favorable

D) $183 Unfavorable

Variable Overhead Efficiency Variance

This variance measures the difference between the actual hours taken to produce a good and the standard hours expected, multiplied by the variable overhead rate per hour.

Variable Overhead

Costs that vary in direct proportion to changes in the operational activity of a business, such as utility bills or raw material costs.

Budgeted Production

represents the amount of production planned for a future period as part of the budgeting process.

- Apprehend the approach to quantifying variable overhead efficiency variances.

Verified Answer

Standard hours for actual output = Standard hours per unit x Actual output

= 2.9 DLHs per unit x 5,400 units

= 15,660 DLHs

Actual variable overhead = Actual hours x Actual variable overhead rate

= 2,130 DLHs x $6.10 per DLH

= $12,993

Standard variable overhead = Standard hours for actual output x Standard variable overhead rate

= 15,660 DLHs x $6.00 per DLH

= $93,960

Variable overhead efficiency variance = (15,660 DLHs - 2,130 DLHs) x $6.00 per DLH

= 13,530 DLHs x $6.00 per DLH

= $81,180 Favorable

Therefore, the correct answer is C, $180 Favorable.

Learning Objectives

- Apprehend the approach to quantifying variable overhead efficiency variances.

Related questions

The Maxit Corporation Has a Standard Costing System in Which ...

Geschke Corporation, Which Produces Commercial Safes, Has Provided the Following ...

The Maxit Corporation Has a Standard Costing System in Which ...

Brummer Corporation Makes a Product Whose Variable Overhead Standards Are ...

The Variable Overhead Efficiency Variance for the Month Is Closest ...