Asked by Jamilla Cason on May 02, 2024

Verified

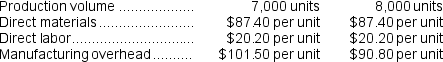

Caraco Corporation has provided the following production and average cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total cost to manufacture 7,300 units is closest to:

The best estimate of the total cost to manufacture 7,300 units is closest to:

A) $1,487,375

B) $1,448,320

C) $1,500,750

D) $1,526,430

Average Cost Data

Refers to the average costs incurred for producing a good, calculated by dividing the total cost of goods produced by the number of goods.

Monthly Production

The total volume of goods or services produced by a company in a single month.

Total Cost

The cumulative amount of resources, monetary or otherwise, expended to produce a good or service, encompassing both fixed and variable expenses.

- Compute the complete manufacturing cost for a given amount of units.

Verified Answer

Total manufacturing overhead at 7,000 units = 7,000 units × $101.50 per unit = $710,500

Variable manufacturing overhead per unit = Change in cost ÷ Change in activity

= ($726,400 - $710,500)÷ (8,000 units - 7,000 units)

= $15,900 ÷ 1,000 units

= $15.90 per unit

Fixed cost element of manufacturing overhead = Total cost - Variable cost element

= $726,400 - (8,000 units × $15.90 per unit)

= $726,400 - $127,200

= $599,200

Total variable manufacturing cost = Direct materials + Direct labor + Manufacturing overhead

= ($87.40 per unit + $20.20 per unit)+ $15.90 per unit

= $123.50 per unit

Total manufacturing cost = (Total variable manufacturing cost per unit × Total units manufactured)+ Total fixed manufacturing cost

= ($123.50 per unit × 7,300 units)+ $599,200

= $901,550+ $599,200

= $1,500,700

Learning Objectives

- Compute the complete manufacturing cost for a given amount of units.

Related questions

Holton Company Has the Following Equivalent Units for July: Materials ...

In the Shaping Department of Rollins Company the Unit Materials ...

Byrd Company Decided to Analyze Certain Costs for June of ...

Crawford Company Has the Following Equivalent Units for July: Materials ...

Materials Costs of $600000 and Conversion Costs of $642600 Were ...