Asked by Rebecca Groen on May 04, 2024

Verified

Buffalo Company adopted a defined benefit pension plan as of January 1,2015.Buffalo has provided the following information pertaining to its pension plan:

• The projected benefit obligation as of January 1,2015 was determined to be $1,050,000.

• Service cost for 2015 is $225,000.

• Amortization of prior service cost will be $52,500 per year.

• The projected benefit obligation as of December 31,2015 was determined to be $1,380,000.

• The first contribution of $500,000 to the pension plan asset fund was made on December 31,2015.

• The settlement/discount rate is 10%.

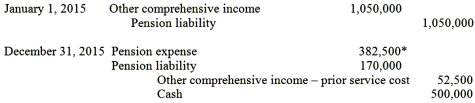

Prepare the necessary journal entries for the year ended December 31,2015.

Defined Benefit Pension Plan

A retirement plan where employee benefits are calculated using a formula that considers factors like length of employment and salary history, with the employer bearing the investment risk.

Projected Benefit Obligation

The present value of all the benefits earned by employees, according to their pension plan up to the measurement date.

Amortization of Prior Service Cost

The process of gradually recognizing the costs of benefits earned by employees in earlier periods in the pension expense over the service life of the employees.

- Comprehend the fundamental elements and computations required for pension and postretirement benefit costs.

- Compute the cost of pension and the obligation of pension.

- Comprehend the effect of actuarial presumptions on the expenses and liabilities associated with pensions.

Verified Answer

*$52,500 (prior service cost amortization)+ $105,000 (interest cost)+ $225,000 (service cost)

*$52,500 (prior service cost amortization)+ $105,000 (interest cost)+ $225,000 (service cost)

Learning Objectives

- Comprehend the fundamental elements and computations required for pension and postretirement benefit costs.

- Compute the cost of pension and the obligation of pension.

- Comprehend the effect of actuarial presumptions on the expenses and liabilities associated with pensions.

Related questions

When Accounting for Funded Postretirement Benefit Plans,which One of the ...

Postretirement Benefits Are Computed Based Upon ...

The Interest Rate That May Be Used to Compute the ...

The Interest Cost Component of Pension Expense in Year Two ...

The Projected Benefit Obligation Is the Present Value of the ...