Asked by Dustin Hansen on May 06, 2024

Verified

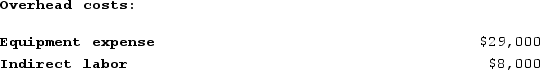

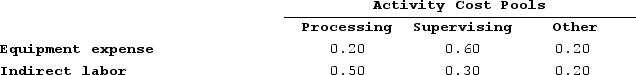

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

Distribution of Resource Consumption Across Activity Cost Pools:

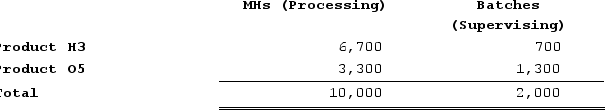

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

A) $5,800

B) $9,800

C) $4,000

D) $7,400

Processing Activity

Activities involved in transforming inputs into finished goods through operations such as assembling, cooking, or chemical processing.

Activity-Based Costing

An accounting method that identifies the activities a firm performs and then assigns indirect costs to products. It improves accuracy of product costing by linking cost more directly to the activities that drive those costs.

Overhead Cost

Indirect expenses related to the general operation of a business, not directly tied to a specific product or service.

- Master the technique of attributing overhead costs to activity cost pools at the onset of Activity-Based Costing.

Verified Answer

For Processing:

Equipment expense = $2,900 * 2 MHs = $5,800

Indirect labor = $3,900 * 0 batches = $0

Total allocated to Processing = $5,800

For Supervising:

Equipment expense = $2,900 * 0 MHs = $0

Indirect labor = $3,900 * 25 batches = $97,500

Total allocated to Supervising = $97,500

For Other:

Equipment expense = $2,900 * 4 MHs = $11,600

Indirect labor = $3,900 * 10 batches = $39,000

Total allocated to Other = $50,600

Therefore, the overhead cost allocated to the Processing activity cost pool is $5,800.

Learning Objectives

- Master the technique of attributing overhead costs to activity cost pools at the onset of Activity-Based Costing.

Related questions

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...

Hagy Corporation Has an Activity-Based Costing System with Three Activity ...

Moorman Corporation Has an Activity-Based Costing System with Three Activity ...

Howell Corporation's Activity-Based Costing System Has Three Activity Cost Pools--Machining ...

Figge and Mathews Public Limited Company, a Consulting Firm, Uses ...