Asked by Brandon Dagley on May 10, 2024

Verified

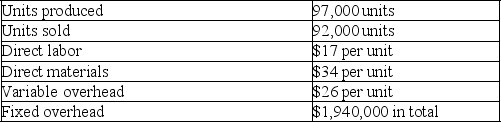

Home Base,Inc.reports the following production cost information:

a.Compute production cost per unit under variable costing.

a.Compute production cost per unit under variable costing.

b.Compute production cost per unit under absorption costing.

c.Determine the cost of ending inventory using variable costing.

d.Determine the cost of ending inventory using absorption costing.

Variable Costing

A method of costing that includes only variable production costs in product costs, treating fixed manufacturing overhead as a period cost to be charged against revenue in the period incurred.

Absorption Costing

A strategy in accounting that involves incorporating costs related to manufacturing, including direct materials, direct labor, and variable and fixed overheads, into the price point of a product.

Production Cost

The total expense incurred in manufacturing a product, including materials, labor, and overhead.

- Calculate production cost per unit, ending inventory costs under both variable and absorption costing.

Verified Answer

b.$77 + ($1,940,000/97,000)FOH = $97 per unit under absorption costing

c.(97,000 units - 92,000 units)× $77 per unit = $385,000 ending inventory under variable costing

d.(97,000 units - 92,000 units)× $97 per unit = $485,000 ending inventory under absorption costing

Learning Objectives

- Calculate production cost per unit, ending inventory costs under both variable and absorption costing.

Related questions

A Company Reports the Following Information Regarding Its Production Cost ...

Lukin Corporation Reports the Following First Year Production Cost Information ...

A Company Reports the Following Information Regarding Its Production Cost ...

Home Base,Inc.reports the Following Production Cost Information ...

Castaway Company Reports the Following First Year Production Cost Information ...