Asked by Michelle Mazur on May 16, 2024

Verified

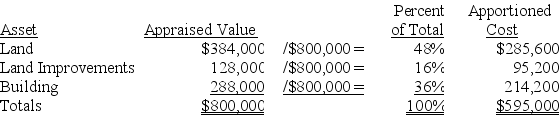

A company paid $595,000 for property that included land appraised at $384,000; land improvements appraised at $128,000; and a building appraised at $288,000.The plan is to use the building as a manufacturing plant.Determine the amounts that should be recorded as:

Land Appraised

The assessed value of land determined by an appraiser, usually for the purposes of taxation, investment analysis, or sale.

Land Improvements

Enhancements made to land to increase its value or usability, such as landscaping, fencing, or adding infrastructure like roads and utilities.

Building Appraised

The assessed value of a building, determined by a professional appraiser based on factors such as location, condition, and market trends.

- Understand and apply the concept of capitalizing costs associated with property purchases.

Verified Answer

Learning Objectives

- Understand and apply the concept of capitalizing costs associated with property purchases.

Related questions

Interest on Money Borrowed to Finance Construction of New Office ...

A Company Made the Following Expenditures in Connection with the ...

When Plant Assets Are Purchased as a Group in a ...

An Asset's Cost Includes All Normal and Reasonable Expenditures Necessary ...

The Cost of an Internally Developed Unidentifiable Intangible Is Expensed ...