Asked by sophia dudich on May 21, 2024

Verified

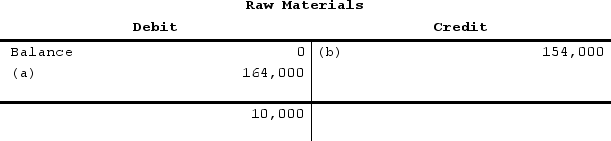

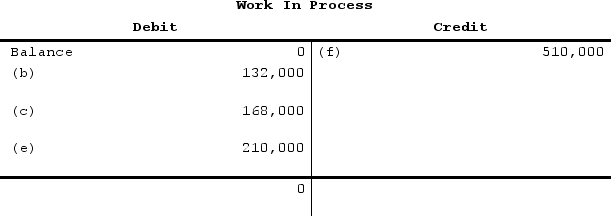

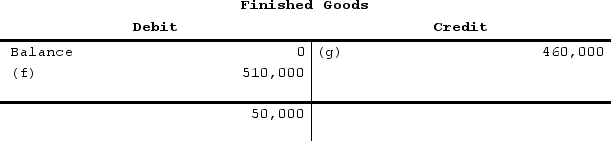

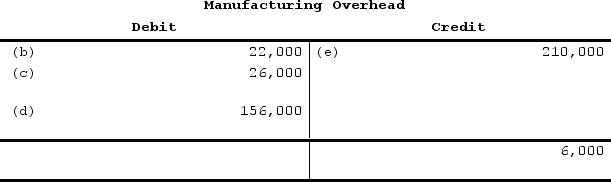

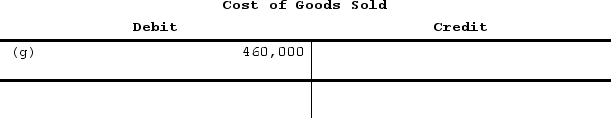

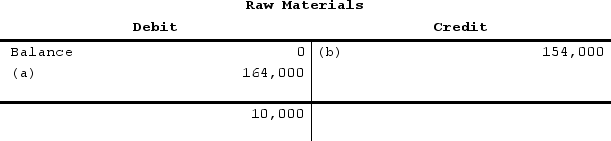

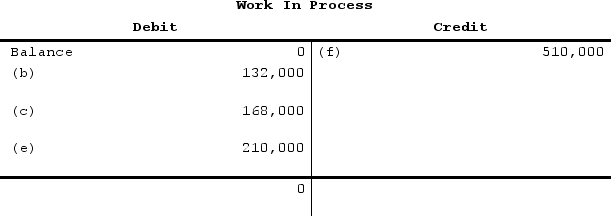

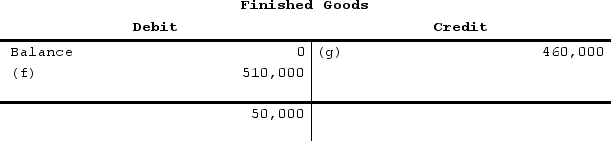

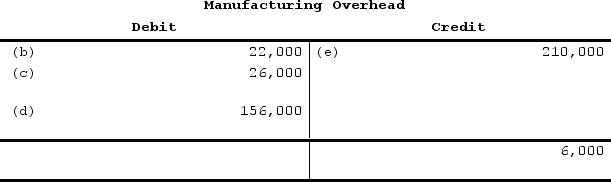

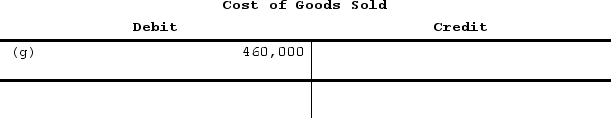

The following accounts are from last year's books at Sharp Manufacturing:

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the manufacturing overhead overapplied or underapplied for the year?

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the manufacturing overhead overapplied or underapplied for the year?

A) $6,000 underapplied

B) $6,000 overapplied

C) $26,000 underapplied

D) $26,000 overapplied

Job-Order Costing

A costing method used to calculate the costs associated with producing specific orders or batches, where the costs for materials, labor, and overhead are compiled and assigned to each job individually.

Overapplied Overhead

A situation where the overhead costs allocated to products or services exceed the actual overhead costs incurred.

Underapplied Overhead

Underapplied overhead occurs when the allocated amount of overhead costs in a costing system is less than the actual overhead incurred.

- Comprehend how overapplied or underapplied manufacturing overhead affects the cost of goods sold.

Verified Answer

Predetermined overhead rate = Estimated total manufacturing overhead / Estimated total direct labor cost

= $690,000 / $460,000

= $1.50 per DL dollar

Now let's calculate applied MOH:

Job

: DL cost = $10,000, MOH applied = 1.5 x 10,000 = $15,000

: DL cost = $10,000, MOH applied = 1.5 x 10,000 = $15,000Job

: DL cost = $20,000, MOH applied = 1.5 x 20,000 = $30,000

: DL cost = $20,000, MOH applied = 1.5 x 20,000 = $30,000Job

: DL cost = $30,000, MOH applied = 1.5 x 30,000 = $45,000

: DL cost = $30,000, MOH applied = 1.5 x 30,000 = $45,000Job

: DL cost = $15,000, MOH applied = 1.5 x 15,000 = $22,500

: DL cost = $15,000, MOH applied = 1.5 x 15,000 = $22,500Job

: DL cost = $25,000, MOH applied = 1.5 x 25,000 = $37,500

: DL cost = $25,000, MOH applied = 1.5 x 25,000 = $37,500Total DL cost = $100,000, Total MOH applied = $150,000

Therefore, MOH overapplied by $6,000 ($150,000 - $144,000) which means that manufacturing overhead was applied more than the actual MOH.

Learning Objectives

- Comprehend how overapplied or underapplied manufacturing overhead affects the cost of goods sold.

Related questions

The Following Accounts Are from Last Year's Books at Sharp ...

Underapplied Overhead I. Describe How Overhead May Be Underapplied ...

Overapplied Manufacturing Overhead Would Result If ...

If Manufacturing Overhead Is Underapplied, Then ...

If the Actual Manufacturing Overhead Cost for a Period Exceeds ...