Asked by Franchezka Mendoza on May 22, 2024

Verified

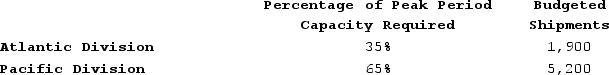

Erholm Corporation has two operating divisions-an Atlantic Division and a Pacific Division. The company's Logistics Department services both divisions. The variable costs of the Logistics Department are budgeted at $31 per shipment. The Logistics Department's fixed costs are budgeted at $411,800 for the year. The fixed costs of the Logistics Department are determined based on peak-period demand.  At the end of the year, actual Logistics Department variable costs totaled $290,700 and fixed costs totaled $431,950. The Atlantic Division had a total of 3,900 shipments and the Pacific Division had a total of 5,100 shipments for the year. How much Logistics Department cost should be charged to the Pacific Division at the end of the year for performance evaluation purposes?

At the end of the year, actual Logistics Department variable costs totaled $290,700 and fixed costs totaled $431,950. The Atlantic Division had a total of 3,900 shipments and the Pacific Division had a total of 5,100 shipments for the year. How much Logistics Department cost should be charged to the Pacific Division at the end of the year for performance evaluation purposes?

A) $391,453

B) $425,770

C) $445,498

D) $409,502

Logistics Department

A division within a company that is responsible for overseeing the flow of goods and materials from suppliers to the end customer, including storage and transportation.

Operating Divisions

Separate segments or areas of a business that perform operations or services distinct from the company's primary business.

Variable Costs

Expenses that directly fluctuate with the amount of goods produced or the extent of services offered.

- Gauge the cost incurred by service departments to be redistributed to specific operating divisions for the purpose of performance appraisal.

Verified Answer

Variable cost per shipment x total number of shipments = $31 x (3,900 + 5,100) = $310,800

Then, we can use the total budgeted cost and the actual cost to calculate the variable spending variance and the fixed spending variance:

Variable spending variance = Actual variable cost - Budgeted variable cost = $290,700 - $310,800 = -$20,100 (favorable)

Fixed spending variance = Actual fixed cost - Budgeted fixed cost = $431,950 - $411,800 = $20,150 (unfavorable)

Next, we need to allocate the fixed cost between the two divisions based on the number of shipments:

Fixed cost allocation rate = Budgeted fixed cost / Total number of shipments = $411,800 / (3,900 + 5,100) = $45.60 per shipment

Fixed cost allocated to Pacific Division = Fixed cost allocation rate x Number of shipments for Pacific Division = $45.60 x 5,100 = $232,560

Finally, we can calculate the total logistics cost for the Pacific Division by adding the actual variable cost and the allocated fixed cost:

Total logistics cost for Pacific Division = Actual variable cost + Fixed cost allocated to Pacific Division = $290,700 + $232,560 = $523,260

Therefore, the Logistics Department cost that should be charged to the Pacific Division for performance evaluation purposes is $425,770 (variable cost of $31 x 5,100 shipments + allocated fixed cost of $232,560).

Learning Objectives

- Gauge the cost incurred by service departments to be redistributed to specific operating divisions for the purpose of performance appraisal.

Related questions

Fox Company Has the Following Data Concerning the Machine-Hours in ...

Lakeside Nursing Home Has Two Operating Departments, Custodial Care and ...

Anchor Corporation Has Two Service Departments, Personnel and Engineering, and ...

Dainels Corporation Uses the Step-Down Method to Allocate Service Department ...

Oaks Company Maintains a Cafeteria for Its Employees ...