Asked by Daisy Farhm on May 22, 2024

Verified

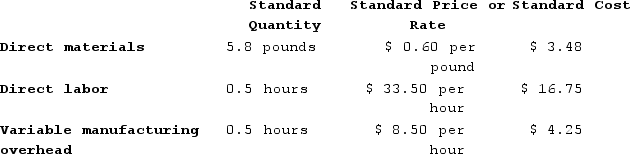

Puvo, Incorporated, manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product:  During March, the following activity was recorded by the company:The company produced 2,400 units during the month.A total of 19,400 pounds of material were purchased at a cost of $13,580.There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.Variable manufacturing overhead costs during March totaled $14,061.The direct materials purchases variance is computed when the materials are purchased.The materials price variance for March is:

During March, the following activity was recorded by the company:The company produced 2,400 units during the month.A total of 19,400 pounds of material were purchased at a cost of $13,580.There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse.During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour.Variable manufacturing overhead costs during March totaled $14,061.The direct materials purchases variance is computed when the materials are purchased.The materials price variance for March is:

A) $1,940 Unfavorable

B) $1,940 Favorable

C) $1,750 Favorable

D) $1,750 Unfavorable

Materials Price Variance

The difference between the actual cost of materials purchased and the expected cost, often used to monitor and control production costs.

Direct Labor-Hours

The total hours of labor directly involved in the production of goods or services, often used as a basis for allocating labor costs to products.

Variable Manufacturing Overhead

Indirect manufacturing costs that fluctuate with production volume, such as utilities and maintenance expenses.

- Inspect and tally variations in direct materials, with an emphasis on price and quantity disparities.

Verified Answer

(Standard price - Actual price) x Actual quantity = ($0.75 - $0.70) x 19,400 pounds = $970 U

Therefore, the materials price variance for March is $970 unfavorable.

Learning Objectives

- Inspect and tally variations in direct materials, with an emphasis on price and quantity disparities.

Related questions

The Total Direct Materials Cost Variance Is ...

If the Actual Quantity of Direct Materials Used in Producing ...

Tharaldson Corporation Makes a Product with the Following Standard Costs ...

Doogan Corporation Makes a Product with the Following Standard Costs ...

Milar Corporation Makes a Product with the Following Standard Costs ...