Asked by Abhijith Jayakumar on May 23, 2024

Verified

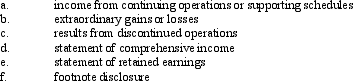

For income reporting purposes, items can appear in any of the following components of the income statement, retained earnings statement, and related schedules and footnotes:

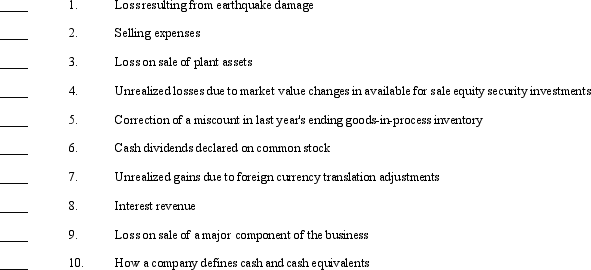

Several items of accounting information are listed below:

Several items of accounting information are listed below:

Required:

Required:

By placing the letters (a-f)in the spaces provided above, identify where the information would be most appropriately reported.If the information would not appear in any of the above components, place an (X)in the space.

Income Reporting

The process of declaring revenue earned by an individual or entity within a certain time frame, often for tax purposes.

Retained Earnings Statement

A financial document that shows how a company's retained earnings have changed over a reporting period due to net income and dividend payouts.

- Identify proper reporting locations for various items of accounting information within financial statements and notes.

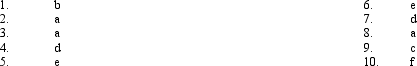

Verified Answer

SA

Learning Objectives

- Identify proper reporting locations for various items of accounting information within financial statements and notes.

Related questions

When an Interest-Bearing Note Matures the Balance in the Notes ...

The Entry to Record the Proceeds Upon Issuing an Interest-Bearing ...

The Difference Between a Classified Balance Sheet and One That ...

A Merchandiser's Classified Balance Sheet Reports Merchandise Inventory as a ...

The Adjusting Entry to Reflect Inventory Shrinkage Is a Debit ...