Asked by raman rainkh on Jun 03, 2024

Verified

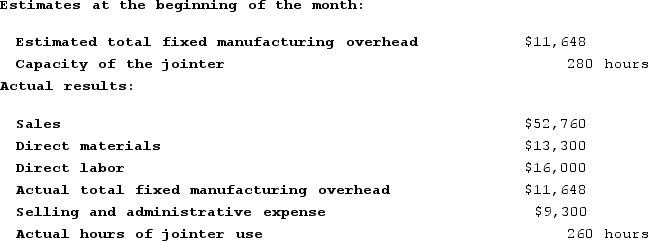

Mausser Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated jointer. Additional information is provided below for the most recent month:  The gross margin that would be reported on the income statement prepared for internal management purposes would be closest to:

The gross margin that would be reported on the income statement prepared for internal management purposes would be closest to:

A) $52,760

B) $3,344

C) $12,644

D) $11,812

Job-Order Costing

An accounting method that collects and assigns manufacturing costs to individual units or batches of production, suitable for customized products.

Predetermined Overhead Rate

An estimate used to allocate manufacturing overhead to products, calculated before the accounting period begins based on expected costs and activity levels.

Gross Margin

The difference between revenue and cost of goods sold, divided by revenue, expressed as a percentage; it measures how efficiently a company uses its resources to make products.

- Analyze the effect of manufacturing overhead charges on gross profitability.

Verified Answer

Direct materials: $29,300

Direct labor: $21,880

Overhead (based on the predetermined overhead rate):

Job 191: 3,445 machine-hours × $24.20/hour = $83,299

Job 192: 4,860 machine-hours × $24.20/hour = $117,612

Total overhead = $200,911

Total cost of production = Direct materials + Direct labor + Overhead

Job 191: $29,300 + $21,880 + $83,299 = $134,479

Job 192: $29,300 + $21,880 + $117,612 = $168,792

Total cost of production = $303,271

Total sales revenue = $348,000

COGS = $303,271

Gross margin = Total sales revenue - COGS = $44,729

Therefore, the gross margin that would be reported on the income statement prepared for internal management purposes is $12,644 (28.3% of total sales revenue) which is option C.

Learning Objectives

- Analyze the effect of manufacturing overhead charges on gross profitability.

Related questions

Dews Corporation Manufactures One Product ...

Which of the Following Statements Is True for Year 2 ...

Under Absorption Costing, the Ending Inventory for the Year Would ...

During March, Pendergraph Corporation Incurred $60,000 of Actual Manufacturing Overhead ...

Sparacino Corporation Has Provided the Following Information: If 5,000 ...