Asked by Ghost Nappa on Jun 05, 2024

Verified

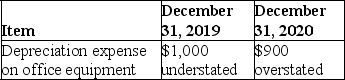

The financial statements of Franklin Company contained the following errors:

A.Was net income for 2019 understated or overstated? Briefly explain your answer.

A.Was net income for 2019 understated or overstated? Briefly explain your answer.

B.1.Considering the effect of the errors of both years at December 31,2020,is retained earnings overstated or understated,and by what amount?

2.Briefly explain your answer to part B (1).

Retained Earnings

The portion of a company's profit that is held back and not distributed to shareholders as dividends, used for investment or paying off debt.

- Understand the consequences for financial statements when amortization or depreciation expenses are not recorded.

- Identify and account for impairment losses on assets and their effect on financial statements.

Verified Answer

ZK

Zybrea KnightJun 06, 2024

Final Answer :

A.Overstated.If depreciation expense is understated,then net income is overstated.

B.1.Retained earnings at December 31,2020 is overstated by $100.

2.Net income of 2019 is overstated by $1,000 because the expense is understated.Net income of 2020 is understated by $900 because the expense is overstated.The net effect on retained earnings is an overstatement of $100.

B.1.Retained earnings at December 31,2020 is overstated by $100.

2.Net income of 2019 is overstated by $1,000 because the expense is understated.Net income of 2020 is understated by $900 because the expense is overstated.The net effect on retained earnings is an overstatement of $100.

Learning Objectives

- Understand the consequences for financial statements when amortization or depreciation expenses are not recorded.

- Identify and account for impairment losses on assets and their effect on financial statements.

Related questions

During 2019,the Bowtie Company Reported Net Income of $1,872 Million,depreciation ...

GAAP Now Requires That Impairment Losses Be Recognized When They ...

Failure to Record a Liability Will Probably ...

Which of the Following Statements About Asset Impairments Is False ...

Which of the Following Is Correct ...