Asked by Joanna Harrison on Jun 06, 2024

Verified

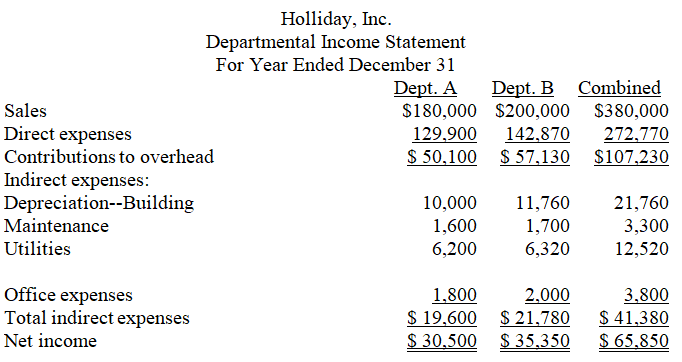

Holliday,Inc.,operates a retail store with two departments,A and B.Its departmental income statement for the current year follows:

Holliday allocates building depreciation,maintenance,and utilities on the basis of square footage.Office expenses are allocated on the basis of sales.

Holliday allocates building depreciation,maintenance,and utilities on the basis of square footage.Office expenses are allocated on the basis of sales.

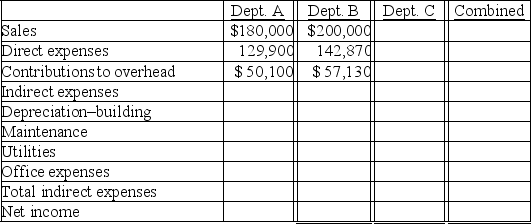

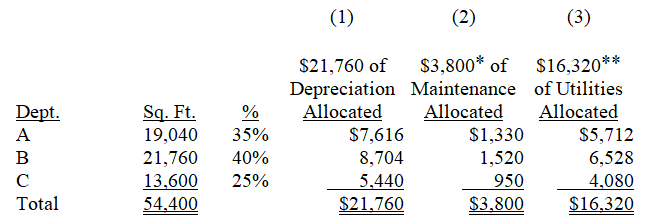

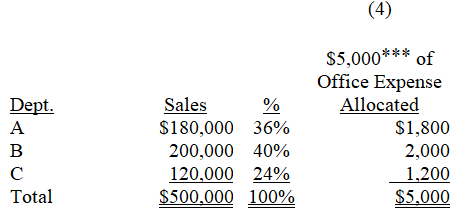

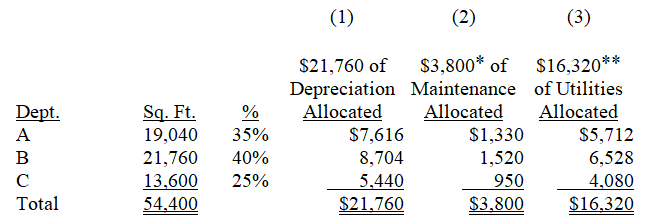

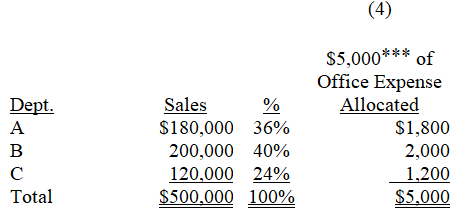

Management is considering an expansion to a three-department operation.The proposed Department C would generate $120,000 in additional sales and have a 17.5% contribution to overhead.The company owns its building.Opening Department C would redistribute the square footage to each department as follows: A,19,040; B,21,760 sq.ft.; C,13,600.Increases in indirect expenses would include: maintenance,$500; utilities,$3,800; and office expenses,$1,200.

Complete the following departmental income statements,showing projected results of operations for the three sales departments.(Round amounts to the nearest whole dollar.)

Departmental Income Statement

A financial statement that shows the income, expenses, and net income of different departments within a company.

Contribution To Overhead

The portion of revenue that exceeds direct costs and contributes to covering a company's fixed expenses.

- Apply cost allocation principles to hypothetical expansions and assess their impact on departmental income statements and company overhead.

Verified Answer

LN

Leslie NungarayJun 08, 2024

Final Answer :

* $3,300 + $500 = $3,800; ** $12,520 + $3,800 = $16,320; *** $3,800 + $1,200 = $5,000

* $3,300 + $500 = $3,800; ** $12,520 + $3,800 = $16,320; *** $3,800 + $1,200 = $5,000

Learning Objectives

- Apply cost allocation principles to hypothetical expansions and assess their impact on departmental income statements and company overhead.

Related questions

Departmental Information Is Usually Distributed to the Public as Part ...

Knipple Woodworking Corporation Produces Fine Cabinets ...

Strzelecki Corporation Uses the Step-Down Method to Allocate Service Department ...

Cervetti, Incorporated, Allocates Service Department Costs to Operating Departments Using ...

In the Two-Stage Cost Allocation,________ Costs Are Allocated to Operating ...