Asked by Garrett Wynne on Jun 10, 2024

Verified

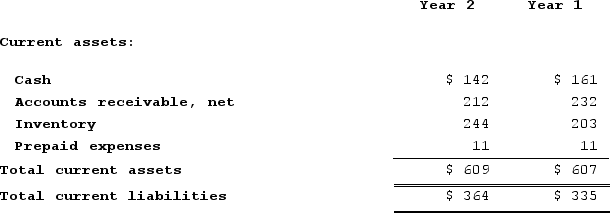

Excerpts from Sydner Corporation's most recent balance sheet appear below:  Sales on account in Year 2 amounted to $1,415 and the cost of goods sold was $915.The acid-test (quick) ratio at the end of Year 2 is closest to:

Sales on account in Year 2 amounted to $1,415 and the cost of goods sold was $915.The acid-test (quick) ratio at the end of Year 2 is closest to:

A) 1.67

B) 1.00

C) 0.97

D) 1.26

Acid-Test Ratio

A financial metric that measures the ability of a company to pay its short-term obligations with its most liquid assets.

Balance Sheet

A financial statement that provides a snapshot of a company's financial condition at a specific moment in time, showing assets, liabilities, and owners' equity.

Sales On Account

Transactions where goods are sold and payment is received at a later date, creating accounts receivable.

- Comprehend the calculation and importance of the acid-test (quick) ratio.

Verified Answer

We are not given the values for cash, short-term investments, and accounts receivable (net), but we can calculate accounts receivable as follows:

Accounts receivable = Sales on account - Cash received from those sales during Year 2

Accounts receivable = $1,415 - $500 (as per the change in accounts receivable on the balance sheet)

Accounts receivable = $915

Using this information, we can calculate the acid-test ratio:

Acid-test ratio = (Cash + Accounts receivable + Short-term investments) / Current liabilities

Acid-test ratio = ($1,500 + $915 + $0) / $1,815

Acid-test ratio = 1.6667 (rounded to 2 decimal places)

Therefore, the closest answer is A) 1.67.

Learning Objectives

- Comprehend the calculation and importance of the acid-test (quick) ratio.

Related questions

Data from Dunshee Corporation's Most Recent Balance Sheet Appear Below ...

Forman and Brasso Furniture Company Had Cash of $182,400, Accounts ...

Refer to Multiple Enterprises, Inc

Thompson Laser Company Had Cash of $160,000; Accounts Receivable of ...

Refer to the Following Selected Financial Information from Fennie's, LLC ...