Asked by Cameron Hutton on Jun 11, 2024

Verified

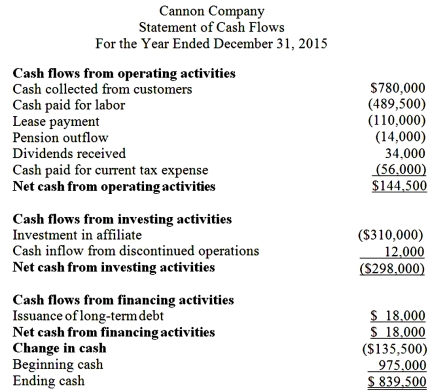

Cannon Company has the following information for the year ending December 31,2015:

• Long-term debt of $18,000 was issued for cash.

• Cash paid for labor during 2015 amounted to $489,500.

• During the year,Cannon experienced a pension outflow of $14,000.

• Dividends of $34,000 were received.

• Cannon's cash balance at the beginning of 2015 was $975,000;at the end of 2015 the cash balance was $839,500.

• The company made an investment of $310,000 in an affiliate company.

• A lease payment of $110,000 was made on November 1,2015.There is no asset recorded in connection with the lease.

• During the year,Cannon collected $780,000 cash from customers.

• Cash paid for income taxes amounted to $56,000 for all of 2015.

• During 2015,Cannon discontinued its consumer electronics division.The business was sold resulting in a $12,000 net cash inflow.

Required:

Prepare Cannon Company's statement of cash flows for the year ending December 31,2015.

Long-term Debt

Borrowings or financial obligations that are due to be repaid more than one year from the balance sheet date.

Pension Outflow

A financial term referring to payments made to retired employees or beneficiaries from a pension fund.

Lease Payment

Regular payments made by a lessee to a lessor for the use of an asset over the lease term, according to the lease agreement.

- Inspect changes in balance sheet positions to determine the origins of cash flows, categorizing them into operating, investing, and financing activities.

- Identify the differences in cash flow categories (operating, investing, financing) across a range of transactions.

Verified Answer

Learning Objectives

- Inspect changes in balance sheet positions to determine the origins of cash flows, categorizing them into operating, investing, and financing activities.

- Identify the differences in cash flow categories (operating, investing, financing) across a range of transactions.

Related questions

Which of the Following Transactions Would Be Reported Within the ...

When the Year-To-Year Changes in Comparative Balance Sheet Accounts Do ...

Declaration and Issue of a Stock Dividend ...

Preparing the Financing Activities Section of the Statement of Cash ...

Cash Flows from Investing Activities, as Part of the Statement ...