Asked by Krystina Colon on Jun 11, 2024

Verified

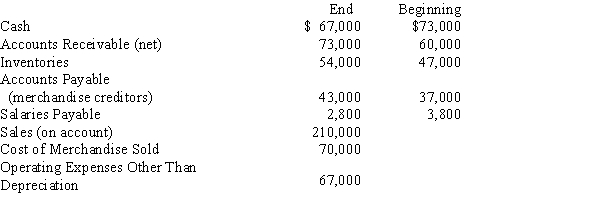

Balances of the current asset and current liability accounts at the end and beginning of the year are as follows:  Use the direct method to prepare the Cash flows from operating activities section of a statement of cash flows.

Use the direct method to prepare the Cash flows from operating activities section of a statement of cash flows.

Current Liability

A current liability is a company's short-term financial obligation that is due within one year or within the normal operating cycle.

Current Asset

Assets expected to be converted into cash, sold, or consumed within one year or the normal operating cycle of a business, whichever is longer.

Direct Method

A way of preparing the cash flow statement where actual cash flow information from the company's operations is used, as opposed to the indirect method which adjusts net income for accruals.

- Understand the direct method for reporting cash flows from operating activities.

- Analyze changes in balance sheet accounts to prepare the cash flows from operating activities section of a statement of cash flows.

Verified Answer

CS

Chris SandersJun 12, 2024

Final Answer :

Cash flows from operating activities: Cash received from customers $197,000 Cash payments for merchandise (71,000) Cash payments for operating expenses (68,000) Net cash flow from operating activities $58,000\begin{array}{l}\text { Cash flows from operating activities: }\\\begin{array} { l c } \text { Cash received from customers } & \$ 197,000 \\\text { Cash payments for merchandise } & ( 71,000 ) \\\text { Cash payments for operating expenses } & ( 68,000 ) \\\text { Net cash flow from operating activities } & \mathbf { \$ 5 8 , 0 0 0 }\end{array}\end{array} Cash flows from operating activities: Cash received from customers Cash payments for merchandise Cash payments for operating expenses Net cash flow from operating activities $197,000(71,000)(68,000)$58,000

Learning Objectives

- Understand the direct method for reporting cash flows from operating activities.

- Analyze changes in balance sheet accounts to prepare the cash flows from operating activities section of a statement of cash flows.