Asked by ethan battista on Jun 14, 2024

Verified

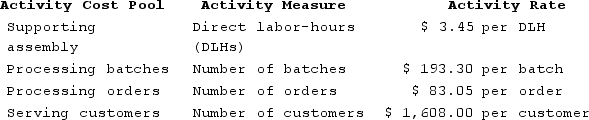

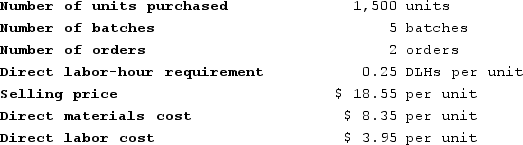

Delauder Enterprises makes a variety of products that it sells to other businesses. The company's activity-based costing system has four activity cost pools for assigning costs to products and customers. Details concerning that activity-based costing system are listed below:  The cost of serving customers, $1,608.00 per customer, is the cost of serving a customer for one year. Grennon Corporation buys only one of the company's products. The details of last year's purchases of this product are listed below:

The cost of serving customers, $1,608.00 per customer, is the cost of serving a customer for one year. Grennon Corporation buys only one of the company's products. The details of last year's purchases of this product are listed below:

According to the activity-based costing system, the total overhead cost for this customer this past year was closest to:

According to the activity-based costing system, the total overhead cost for this customer this past year was closest to:

A) $4,034.35

B) $22,484.35

C) $2,426.35

D) $18,450.00

Activity Cost Pools

A method in managerial accounting used to allocate indirect costs to products or services based on specific activities that drive costs.

Activity-Based Costing

An accounting method that identifies the activities a firm performs and assigns costs to products and services based on the actual consumption of resources.

Total Overhead Cost

The sum of all indirect costs of manufacturing or providing services that are not directly tied to a specific product or job.

- Calculate the overhead cost assigned to products and customers under ABC.

Verified Answer

Activity 1: Product design = $335.50 per unit x 150 units = $50,325

Activity 2: Order processing = $487.50 per order x 2 orders = $975

Activity 3: Product distribution = $6.20 per unit x 150 units = $930

Activity 4: Customer service = $1,608 per customer x 1 customer = $1,608

Total overhead cost for Grennon Corporation for the year = $50,325 + $975 + $930 + $1,608 = $53,838

Overhead cost per unit = Total overhead cost / total units sold = $53,838 / 150 units = $358.92 per unit

The cost of serving a customer for one year is already provided ($1,608.00). Therefore, the total overhead cost for the customer for the year can be calculated as follows:

Total overhead cost = Cost of serving a customer x Number of customers = $1,608 x 1 = $1,608

Total cost of the product for Grennon Corporation = (150 units x $92) + $358.92 per unit = $14,780 + $358.92 = $15,138.92

Therefore, the total overhead cost for Grennon Corporation as per the activity-based costing system is $1,608, and the closest answer choice is A) $4,034.35.

Learning Objectives

- Calculate the overhead cost assigned to products and customers under ABC.

Related questions

Flemming Corporation Uses Activity-Based Costing to Compute Product Margins ...

Delauder Enterprises Makes a Variety of Products That It Sells ...

Handal Corporation Uses Activity-Based Costing to Compute Product Margins ...

ScholfieldEnterprises Makes a Variety of Products That It Sells to ...

Bachrodt Corporation Uses Activity-Based Costing to Compute Product Margins ...