Asked by estefani Ramirez on Jun 15, 2024

Verified

Hubbard Company purchased a truck on January 1,2018,at a cost of $34,000.The company estimated that the truck would have a useful life of 4 years and a residual value of $4,000.

A.Calculate depreciation expense under straight line and double declining balance for 2018-2021.

B.Which of the two methods would result in lower net income in 2018 and 2021?

Double Declining Balance

An accelerated method of depreciation which doubles the rate at which an asset is depreciated compared to the straight-line method.

- Evaluate and determine the reduction in value of assets by employing methods like straight-line, double-declining balance, and units-of-production techniques.

Verified Answer

MA

Muhamad AzamuddinJun 20, 2024

Final Answer :

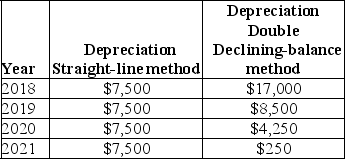

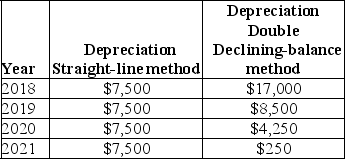

A.

Straight-line: ($34,000 - 4,000)÷ 4 years = $7,500.

Straight-line: ($34,000 - 4,000)÷ 4 years = $7,500.

Declining-balance:

2018 2/4 = $17,000.

2019 ($34,000 - $17,000)× 2/4 = $8,500.

2020 ($34,000 - $25,500)× 2/4 = $4,250.

2021 Book value $4,250 - $4,000 residual value = $250.

B.Lower net income: 2018,double declining-balance;2021,straight-line.

Straight-line: ($34,000 - 4,000)÷ 4 years = $7,500.

Straight-line: ($34,000 - 4,000)÷ 4 years = $7,500.Declining-balance:

2018 2/4 = $17,000.

2019 ($34,000 - $17,000)× 2/4 = $8,500.

2020 ($34,000 - $25,500)× 2/4 = $4,250.

2021 Book value $4,250 - $4,000 residual value = $250.

B.Lower net income: 2018,double declining-balance;2021,straight-line.

Learning Objectives

- Evaluate and determine the reduction in value of assets by employing methods like straight-line, double-declining balance, and units-of-production techniques.

Related questions

Augie Corporation Purchased a Truck at a Cost of $60,000 ...

Which Depreciation Method Ignores Residual Value When Computing the Depreciable ...

Worth Manufacturing Company Purchased a New Production Machine on July ...

Champion Company Purchased and Installed Carpet in Its New General ...

On July 1, Hartford Construction Purchases a Bulldozer for $228,000 ...