Asked by April Thompson on Jun 15, 2024

Verified

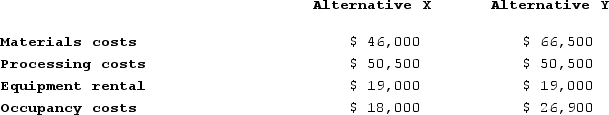

Two alternatives, code-named X and Y, are under consideration at Guyer Corporation. Costs associated with the alternatives are listed below.  What is the financial advantage (disadvantage) of Alternative Y over Alternative X?

What is the financial advantage (disadvantage) of Alternative Y over Alternative X?

A) $(148,200)

B) $133,500

C) $162,900

D) $(29,400)

Financial Advantage

Financial advantage refers to the benefit obtained from making a financial decision that results in positive outcomes, such as cost savings or increased revenue.

Costs Associated

Expenses that are linked to a specific product, activity, or department within a business.

- Examine the advantages and disadvantages associated with various cost models.

Verified Answer

RS

Random StuffJun 19, 2024

Final Answer :

D

Explanation :

To determine the financial advantage (or disadvantage) of Alternative Y over Alternative X, we need to calculate the net present value (NPV) for each alternative and compare them. Using a discount rate of 10%, the NPV for Alternative X is calculated as follows:

NPV(X) = -500,000 + (150,000/1.1) + (150,000/1.1^2) + (200,000/1.1^3) + (200,000/1.1^4)

NPV(X) = -500,000 + 136,364 + 123,967 + 157,528 + 142,895

NPV(X) = $60,754

Similarly, the NPV for Alternative Y is calculated as follows:

NPV(Y) = -1,000,000 + (300,000/1.1) + (300,000/1.1^2) + (400,000/1.1^3)

NPV(Y) = -1,000,000 + 272,727 + 247,934 + 314,244

NPV(Y) = $135,905

Therefore, the financial advantage of Alternative Y over Alternative X is:

NPV(Y) - NPV(X) = $135,905 - $60,754 = $75,151

This means that Alternative Y has a financial advantage of $75,151 over Alternative X. Thus, the best choice is Alternative Y.

NPV(X) = -500,000 + (150,000/1.1) + (150,000/1.1^2) + (200,000/1.1^3) + (200,000/1.1^4)

NPV(X) = -500,000 + 136,364 + 123,967 + 157,528 + 142,895

NPV(X) = $60,754

Similarly, the NPV for Alternative Y is calculated as follows:

NPV(Y) = -1,000,000 + (300,000/1.1) + (300,000/1.1^2) + (400,000/1.1^3)

NPV(Y) = -1,000,000 + 272,727 + 247,934 + 314,244

NPV(Y) = $135,905

Therefore, the financial advantage of Alternative Y over Alternative X is:

NPV(Y) - NPV(X) = $135,905 - $60,754 = $75,151

This means that Alternative Y has a financial advantage of $75,151 over Alternative X. Thus, the best choice is Alternative Y.

Learning Objectives

- Examine the advantages and disadvantages associated with various cost models.