Asked by Writes Wanderlust on Jun 23, 2024

Verified

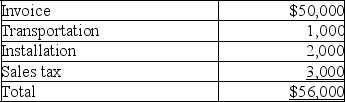

On January 1,2019,Trenton Company purchased a machine costing $50,000.Trenton also incurred the following costs: transportation,$1,000;installation,$2,000;and sales tax,$3,000.

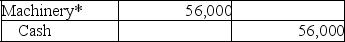

Prepare the journal entry to record the machine acquisition assuming cash was paid.

Journal Entry

A record in accounting that represents a transaction in which there has been a change in the value of the company's assets, liabilities, or equity.

Installation Costs

Expenses associated with setting up or installing equipment, machinery, or software, making them ready for use.

- Comprehend the basic accounting principles related to tangible assets, like buildings and machinery, covering their acquisition, amortization, and divestment.

Verified Answer

AS

Learning Objectives

- Comprehend the basic accounting principles related to tangible assets, like buildings and machinery, covering their acquisition, amortization, and divestment.

Related questions

Waterloo Corporation Purchased Factory Equipment for a Cost of $1,800,000 ...

A Company Purchased Land with a Building for a Total ...

If a Fixed Asset with a Book Value of $10,000 ...

Though a Piece of Equipment Is Still Being Used, the ...

Which of the Following Statements Is Correct with Respect to ...

*Computations:

*Computations: