Asked by PETER MATOKE on Jun 25, 2024

Verified

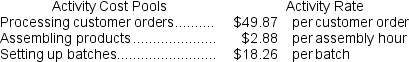

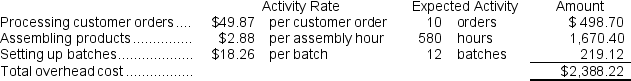

Activity rates from Mcelderry Corporation's activity-based costing system are listed below.The company uses the activity rates to assign overhead costs to products:  Last year, Product Q06J involved 10 customer orders, 580 assembly hours, and 12 batches.How much overhead cost would be assigned to Product Q06J using the activity-based costing system?

Last year, Product Q06J involved 10 customer orders, 580 assembly hours, and 12 batches.How much overhead cost would be assigned to Product Q06J using the activity-based costing system?

A) $71.01

B) $219.12

C) $2,388.22

D) $42,748.02

Activity Rates

Predetermined rates used in activity-based costing to allocate costs to products or services based on specific activities undertaken.

- Calculate rates relating to overhead and utilize these figures to compute product costs as per Activity-Based Costing.

- Comprehend the allocation techniques of overhead costs through various activity drivers.

Verified Answer

SK

Sudhakar KanagalaJun 30, 2024

Final Answer :

C

Explanation :

We need to use the activity rates given in the table to calculate the overhead costs assigned to Product Q06J:

Customer orders:

Activity rate = $120,000 ÷ 2,400 orders = $50/order

Overhead cost assigned to Product Q06J based on customer orders = 10 orders × $50/order = $500

Assembly hours:

Activity rate = $306,000 ÷ 9,000 hours = $34/hour

Overhead cost assigned to Product Q06J based on assembly hours = 580 hours × $34/hour = $19,720

Batch setups:

Activity rate = $230,000 ÷ 460 batches = $500/batch

Overhead cost assigned to Product Q06J based on batch setups = 12 batches × $500/batch = $6,000

Total overhead cost assigned to Product Q06J = $500 + $19,720 + $6,000 = $26,220

Therefore, the correct answer is C) $2,388.22 (rounded to the nearest cent).

Customer orders:

Activity rate = $120,000 ÷ 2,400 orders = $50/order

Overhead cost assigned to Product Q06J based on customer orders = 10 orders × $50/order = $500

Assembly hours:

Activity rate = $306,000 ÷ 9,000 hours = $34/hour

Overhead cost assigned to Product Q06J based on assembly hours = 580 hours × $34/hour = $19,720

Batch setups:

Activity rate = $230,000 ÷ 460 batches = $500/batch

Overhead cost assigned to Product Q06J based on batch setups = 12 batches × $500/batch = $6,000

Total overhead cost assigned to Product Q06J = $500 + $19,720 + $6,000 = $26,220

Therefore, the correct answer is C) $2,388.22 (rounded to the nearest cent).

Explanation :

The overhead cost charged to Product Q06J is:

Learning Objectives

- Calculate rates relating to overhead and utilize these figures to compute product costs as per Activity-Based Costing.

- Comprehend the allocation techniques of overhead costs through various activity drivers.