Asked by Amrita Nijjer on Jun 26, 2024

Verified

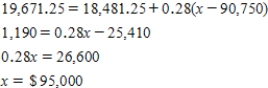

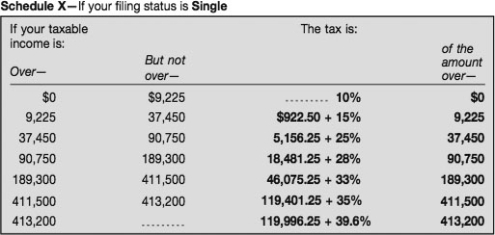

Cody filed as a single taxpayer and determined his taxes to be $19,671.25 using the following tax table.What was his taxable income?

Taxable Income

The portion of an individual's or entity's income that is subject to taxation by governing authorities.

Tax Table

A chart provided by tax authorities that displays the amount of tax due based on income levels, used to determine tax liabilities.

Single Taxpayer

A filing status for individuals who are unmarried or legally separated and responsible for filing their own tax returns.

- Use tax tables to determine tax liabilities based on taxable income.

Verified Answer

CZ

Learning Objectives

- Use tax tables to determine tax liabilities based on taxable income.