Asked by Janninah Miller on Jun 26, 2024

Verified

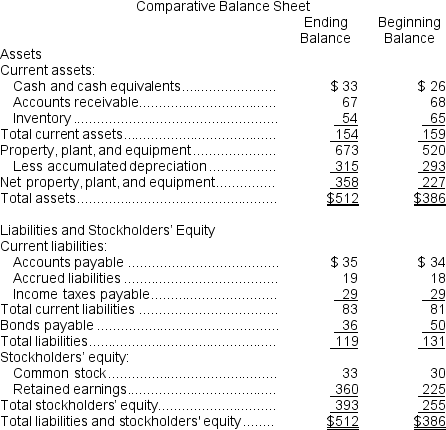

Autry Corporation's balance sheet and income statement appear below:

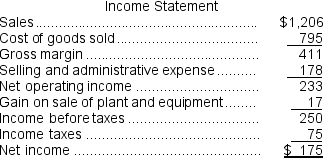

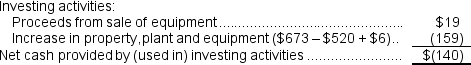

Cash dividends were $40.The company sold equipment for $19 that was originally purchased for $6 and that had accumulated depreciation of $4.The net cash provided by (used in) investing activities for the year was:

Cash dividends were $40.The company sold equipment for $19 that was originally purchased for $6 and that had accumulated depreciation of $4.The net cash provided by (used in) investing activities for the year was:

A) $19

B) $140

C) ($159)

D) ($140)

Accumulated Depreciation

The total amount of a tangible asset's cost that has been allocated as depreciation expense since the asset was acquired and put into use.

Cash Dividends

Cash distributions from a company's earnings to its shareholders.

Balance Sheet

An account that outlines the financial position of a company, detailing its assets, liabilities, and owners' equity at a given point in time.

- Perceive the segments constituting net cash received from (or deployed in) investment actions.

Verified Answer

The sale of equipment for $19 results in a gain of $9 ($19 - $6 - $4), which means that this is the cash inflow from investing activities. The cash dividends paid of $40 are a cash outflow from financing activities and do not affect investing activities.

Therefore, the net cash provided by (used in) investing activities for the year is:

$19 (cash inflow from sale of equipment) - $0 (no cash outflow for equipment purchases) = $19

However, the question asks for the net cash provided by (used in) investing activities, not just cash inflow. Therefore, the answer is:

$19 (cash inflow from sale of equipment) - $159 (cash outflow from paying dividends) = ($140)

Learning Objectives

- Perceive the segments constituting net cash received from (or deployed in) investment actions.

Related questions

The Net Cash Provided by (Used In)investing Activities Last Year ...

Based Solely on the Information Above, the Net Cash Provided ...

The Net Cash Provided by (Used In)financing Activities Last Year ...

The Net Cash Provided by (Used In)operating Activities Last Year ...

The Net Cash Provided by (Used In)financing Activities Last Year ...