Asked by Grace Ferreira on Jun 28, 2024

Verified

The value of the company's inventory on November 30 under absorption costing would be:

A) $54,000

B) $66,000

C) $78,000

D) $81,000

Absorption Costing

A method of accounting that includes all manufacturing costs, both variable and fixed, in the valuation of inventory and cost of goods sold.

- Determine the value of inventory under absorption costing.

Verified Answer

JM

Jasmyne McGeeJul 02, 2024

Final Answer :

B

Explanation :

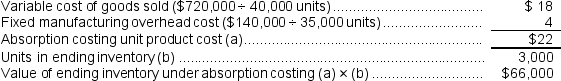

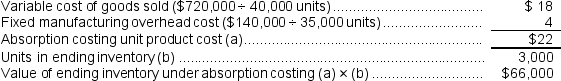

Units sold = $1,200,000 ÷ $30 per unit = 40,000 units

Units in beginning inventory + Units produced = Units sold + Units in ending inventory

8,000 units + 35,000 units = 40,000 units + Units in ending inventory

Units in ending inventory = 8,000 units + 35,000 units - 40,000 units = 3,000 units

Units in beginning inventory + Units produced = Units sold + Units in ending inventory

8,000 units + 35,000 units = 40,000 units + Units in ending inventory

Units in ending inventory = 8,000 units + 35,000 units - 40,000 units = 3,000 units

Learning Objectives

- Determine the value of inventory under absorption costing.

Related questions

Krepps Corporation Produces a Single Product ...

IFRS Requires the Use of Absorption Costing

Lukin Corporation Reports the Following First Year Production Cost Information ...

Home Base,Inc.reports the Following Production Cost Information ...

Home Base,Inc.reports the Following Production Cost Information ...