Asked by Joshua Rieser on Jun 29, 2024

Verified

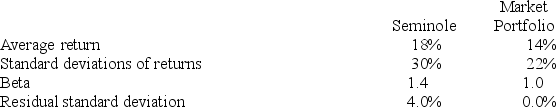

The following data are available relating to the performance of Seminole Fund and the market portfolio:

The risk-free return during the sample period was 6%.

If you wanted to evaluate the Seminole Fund using the M2 measure, what percent of the adjusted portfolio would need to be invested in T-Bills?

A) -36% (borrow)

B) 50%

C) 8%

D) 36%

E) 27%

M2 Measure

A broad measurement of a country's money supply that includes cash, checking deposits, and easily convertible near money, such as savings deposits and money market securities.

T-Bills

Short-term government securities with maturity periods of one year or less, considered a safe and liquid investment.

- Understand the technique for determining the cumulative superior returns of managed investment portfolios.

Verified Answer

ZK

Zybrea KnightJul 06, 2024

Final Answer :

E

Explanation :

22/30 = .7333, or 73.33% invested in Seminole Fund and 1 - 73.33% = 26.67% in T-Bills.

Learning Objectives

- Understand the technique for determining the cumulative superior returns of managed investment portfolios.