Asked by Sygie Lamigo on Jul 02, 2024

Verified

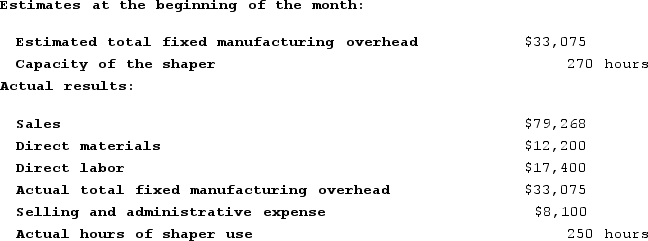

Coble Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated shaper. Additional information is provided below for the most recent month:  The manufacturing overhead applied is closest to:

The manufacturing overhead applied is closest to:

A) $7,500

B) $33,075

C) $8,100

D) $30,625

Job-Order Costing

An accounting method that assigns costs to specific production batches or jobs, useful in industries where goods or services are custom-produced.

Automated Shaper

A machine tool operated using automation for shaping wood, metal, or other materials, enhancing precision and productivity.

Manufacturing Overhead

All manufacturing costs that are not directly related to the production of a product, including indirect labor, maintenance, and utilities.

- Acknowledge the importance of capacity in the calculation of overhead rates and its implications for product costing.

- Allocate indirect costs to products within traditional and activity-based costing frameworks.

Verified Answer

Predetermined overhead rate = Estimated total manufacturing overhead cost / Estimated total capacity of the shaper machine

= $357,500 / 14,300 machine hours

= $25 per machine hour

Now we need to calculate the machine hours used and multiply by the predetermined overhead rate to get the manufacturing overhead applied.

Direct materials used = $218,000

Direct labor incurred = $82,000

Manufacturing overhead incurred = $30,625

Total cost = $330,625

Machine hours used = Direct labor hours worked (7,700) + Machine hours used by automated shaper (5,800)

= 13,500 machine hours

Manufacturing overhead applied = Predetermined overhead rate x Machine hours used

= $25 x 13,500

= $337,500

Therefore, the manufacturing overhead applied is closest to $30,625.

Learning Objectives

- Acknowledge the importance of capacity in the calculation of overhead rates and its implications for product costing.

- Allocate indirect costs to products within traditional and activity-based costing frameworks.

Related questions

Coble Woodworking Corporation Produces Fine Cabinets ...

The Overhead Applied to Each Unit of Product X2 Under ...

Immen Corporation Manufactures Two Products: Product B82O and Product P99Y ...

Hane Corporation Uses the Following Activity Rates from Its Activity-Based ...

Bertsche Enterprises Makes a Variety of Products That It Sells ...