Asked by Elizabeth Welch on Jul 05, 2024

Verified

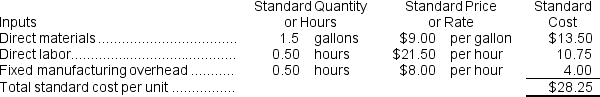

Signore Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standard cost card for the company's only product is as follows:  During the year, the company purchased 34,600 gallons of raw material at a price of $9.10 per gallon and used 30,050 gallons of the raw material to produce 20,100 units of work in process. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash, Raw Materials, Work in Process, Finished Goods, and PP&E (net) .All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

During the year, the company purchased 34,600 gallons of raw material at a price of $9.10 per gallon and used 30,050 gallons of the raw material to produce 20,100 units of work in process. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash, Raw Materials, Work in Process, Finished Goods, and PP&E (net) .All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the purchase of raw materials is recorded, which of the following entries will be made?

A) $3,460 in the Materials Quantity Variance column

B) ($3,460) in the Materials Price Variance column

C) $3,460 in the Materials Price Variance column

D) ($3,460) in the Materials Quantity Variance column

Materials Price Variance

The difference between the actual cost of materials used in production and the expected (or standard) cost, reflecting changes in material prices.

Materials Quantity Variance

The gap between the actual and expected quantities of materials used in production, with each difference multiplied by the standard unit cost.

Raw Materials Purchase

The acquisition of basic materials needed for the production of goods, a critical input in the manufacturing process.

- Gain insight into the economic effects of discrepancies in the cost and amount of raw materials.

Verified Answer

Materials price variance = AQ × (AP - SP)

= 34,600 gallons × ($9.10 per gallon - $9.00 per gallon)

= 34,600 gallons × ($0.10 per gallon)

= $3,460 U

Favorable variances are entered in the worksheet as positive entries and unfavorable variances as negative entries.

Learning Objectives

- Gain insight into the economic effects of discrepancies in the cost and amount of raw materials.

Related questions

Juliano Corporation Uses a Standard Cost System in Which Inventories ...

Landoni Corporation Uses a Standard Cost System in Which Inventories ...

Johanson Corporation Uses a Standard Cost System in Which Inventories ...

Ladue Corporation Uses a Standard Cost System in Which Inventories ...

The Materials Price Variance for August Is ...