Asked by Gabrielle Richard on Jul 05, 2024

Verified

The following information was taken from the inventory records of the Walker Company:

Product A B C D E Units 75100150100200 Unit cost $5.50$10.00$5.10$5.10$5.00 Replacement cost $6.00$9.00$4.60$4.50$4.50 Net realizable value (NRV) $5.20$12.50$7.00$7.00$7.00 NRV-Normal profit $4.80$10.30$5.25$4.00$4.80\begin{array}{llllll}\text { Product}&\text { A}&\text { B}&\text { C}&\text { D}&\text { E}\\\text { Units } & 75 & 100 & 150 & 100 & 200 \\\text { Unit cost } & \$ 5.50 & \$ 10.00 & \$ 5.10 & \$ 5.10 & \$ 5.00 \\\text { Replacement cost } & \$ 6.00 & \$ 9.00 & \$ 4.60 & \$ 4.50 & \$ 4.50 \\\text { Net realizable value (NRV) } & \$ 5.20 & \$ 12.50 & \$ 7.00 & \$ 7.00 & \$ 7.00 \\\text { NRV-Normal profit } & \$ 4.80 & \$ 10.30 & \$ 5.25 & \$ 4.00 & \$ 4.80\end{array} Product Units Unit cost Replacement cost Net realizable value (NRV) NRV-Normal profit A75$5.50$6.00$5.20$4.80 B100$10.00$9.00$12.50$10.30 C150$5.10$4.60$7.00$5.25 D100$5.10$4.50$7.00$4.00 E200$5.00$4.50$7.00$4.80 Required:

Determine the valuation of the inventory at the lower of cost or market applied to:

a. inclvichual items

b. the inventory as a whole

Lower of Cost or Market

An accounting principle requiring inventory to be recorded at the lower of its original cost or its current market value.

Inventory Valuation

The method used to assign cost to inventory for the purposes of accounting, vital for determining cost of goods sold and ending inventory values.

Net Realizable Value

The estimated selling price of goods minus the costs of their sale or disposal, used in assessing the value of inventory and receivables.

- Utilize the lower of cost or market approach for assessing the value of inventory, on an item-by-item basis as well as for total inventory.

Verified Answer

RM

Roxie MunozJul 11, 2024

Final Answer :

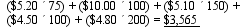

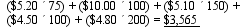

a.

b.

Cost =$412.50+$1,000+$765+$510+$1,000=$3,687.50 Market =$390+$1,030+$777.50+$450+$960=$3.617.50\begin{array} { l } \text { Cost } = \$ 412.50 + \$ 1,000 + \$ 765 + \$ 510 + \$ 1,000 = \$ 3,687.50 \\\text { Market } = \$ 390 + \$ 1,030 + \$ 777.50 + \$ 450 + \$ 960 = \$ 3.617 .50\end{array} Cost =$412.50+$1,000+$765+$510+$1,000=$3,687.50 Market =$390+$1,030+$777.50+$450+$960=$3.617.50

b.

Cost =$412.50+$1,000+$765+$510+$1,000=$3,687.50 Market =$390+$1,030+$777.50+$450+$960=$3.617.50\begin{array} { l } \text { Cost } = \$ 412.50 + \$ 1,000 + \$ 765 + \$ 510 + \$ 1,000 = \$ 3,687.50 \\\text { Market } = \$ 390 + \$ 1,030 + \$ 777.50 + \$ 450 + \$ 960 = \$ 3.617 .50\end{array} Cost =$412.50+$1,000+$765+$510+$1,000=$3,687.50 Market =$390+$1,030+$777.50+$450+$960=$3.617.50

Learning Objectives

- Utilize the lower of cost or market approach for assessing the value of inventory, on an item-by-item basis as well as for total inventory.