Asked by Junwei Zheng on Jul 05, 2024

Verified

One of the disadvantages of the LIFO cost flow assumption is the impact of the liquidation of LIFO layers.

Required:

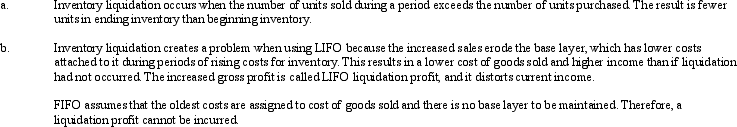

a. Explain what is meant by invent ory liquidation under the LIFO cost flow assumption.

b. Discuss why this may be a serious problem for LIFO but not for FIFO.

LIFO Layers

In the Last-In, First-Out inventory accounting method, layers of inventory purchased at different times (and prices) which can affect the cost of goods sold and ending inventory valuation.

Inventory Liquidation

The process of selling off inventory, typically at reduced prices, to generate cash or reduce excess stock.

LIFO Cost Flow Assumption

An inventory valuation method that assumes the most recently produced or acquired items are sold first, last-in, first-out.

- Gain an understanding of and implement distinct methods of inventory valuation (FIFO, LIFO, weighted average, specific identification) and their influences on financial reports.

- Understand the impact of inventory liquidation under the LIFO cost flow assumption.

Verified Answer

Learning Objectives

- Gain an understanding of and implement distinct methods of inventory valuation (FIFO, LIFO, weighted average, specific identification) and their influences on financial reports.

- Understand the impact of inventory liquidation under the LIFO cost flow assumption.

Related questions

On July 1, the Lavaca Company Began Business with the ...

The Following Information Is Available for Crystal Company Required:Answer ...

Cabinets-R-Us Uses FIFO for Internal Reporting Purposes and LIFO for ...

At December 31, 2010, Johnson, Inc ...

Revolution Hardware Reported $300, 000 of Inventory on December 31 ...