Asked by kylie andrews on Jul 07, 2024

Verified

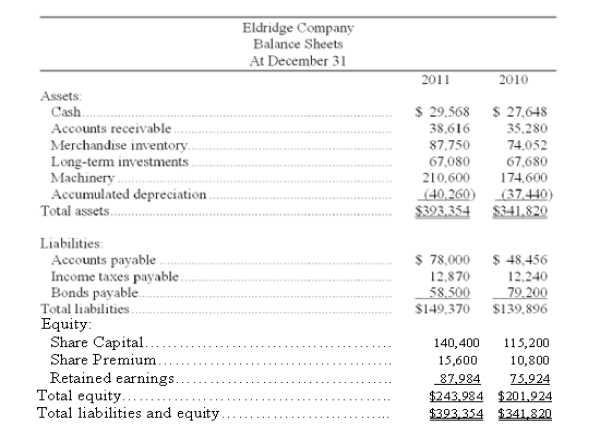

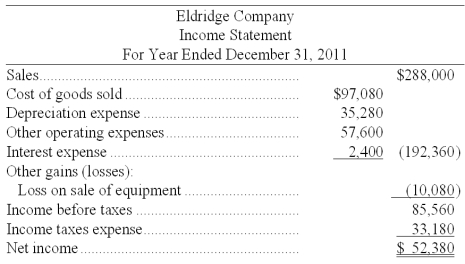

The following information is available for the Eldridge Company:

Additional information:

Additional information:

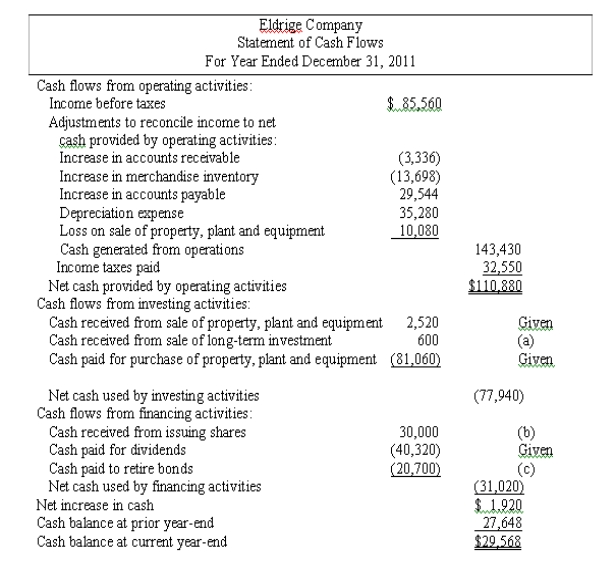

(1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired.

(2) Old machinery with an original cost of $45,060 was sold for $2,520 cash.

(3) New machinery was purchased for $81,060 cash.

(4) Cash dividends of $40,320 were paid. Management wishes to classify this under financing activities.

(5) Additional shares were issued for cash.

Prepare a complete statement of cash flows for year 2011 using the indirect method.

Cash Dividends

Distributions of a company's earnings to its shareholders in the form of cash.

Operating Activities

Business actions that relate directly to the production and delivery of goods and services, central to generating revenue.

- Prepare a complete statement of cash flows for a given period using the indirect method.

Verified Answer

PS

Pooja SehgalJul 10, 2024

Final Answer :

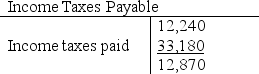

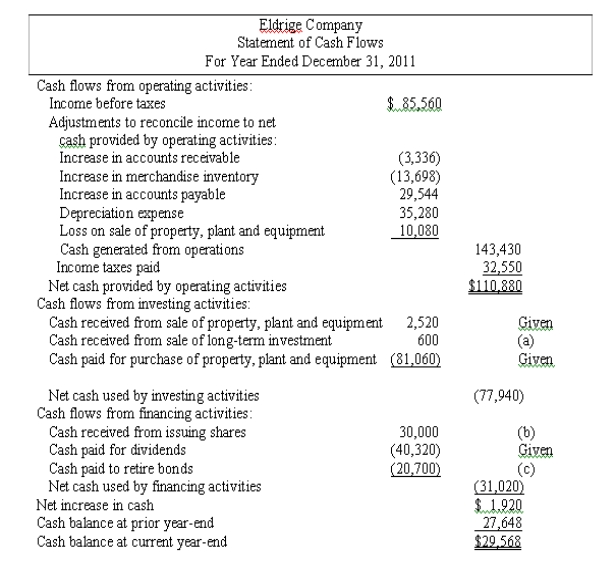

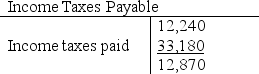

(a) Received from sales of long-term investments: $67,680 - $67,080 = $600

(a) Received from sales of long-term investments: $67,680 - $67,080 = $600

(b) Received from share issuance:

Increase in ordinary shares ($140,400 - $115,200) $25,200

Increase in share premium ($15,600 - $10,800) 4,800

Total received from share issuance $30,000

(c) Paid to retire bonds: $79,200 - $58,500 = $20,700

(a) Received from sales of long-term investments: $67,680 - $67,080 = $600

(a) Received from sales of long-term investments: $67,680 - $67,080 = $600(b) Received from share issuance:

Increase in ordinary shares ($140,400 - $115,200) $25,200

Increase in share premium ($15,600 - $10,800) 4,800

Total received from share issuance $30,000

(c) Paid to retire bonds: $79,200 - $58,500 = $20,700

Learning Objectives

- Prepare a complete statement of cash flows for a given period using the indirect method.

Related questions

Vandy Corporation's Balance Sheet and Income Statement Appear Below ...

Based on the Information Provided Below for Krackle Corp ...

The Following Information Is Available for the Aarons Corporation ...

State the Section (S) of the Statement of Cash Flows ...

The Comparative Balance Sheets of Barry Company, for Years 1 ...