Asked by Bridget Stokes on Jul 09, 2024

Verified

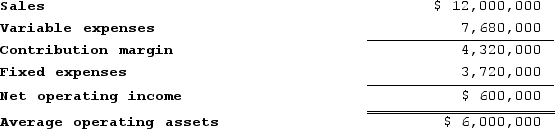

Condren Incorporated reported the following results from last year's operations:  At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

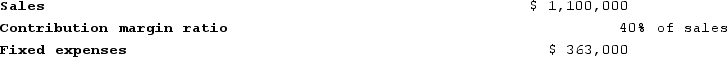

At the beginning of this year, the company has a $1,000,000 investment opportunity with the following characteristics:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined Return on investment (ROI) for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined Return on investment (ROI) for the entire company will be closest to:

A) 1.1%

B) 8.6%

C) 9.7%

D) 11.3%

Return On Investment (ROI)

A financial metric used to evaluate the efficiency of an investment or to compare the efficiencies of several different investments, calculated by dividing net profit by the cost of investment.

- Master the understanding of operational performance metrics, including net operating income, margin, turnover, and ROI determinations.

Verified Answer

IN

Irabaruta Nay-deenJul 09, 2024

Final Answer :

C

Explanation :

To calculate the ROI for the entire company after pursuing the investment opportunity, we need to add the income and investment from the new opportunity to the previous year's values:

Total income = $1,600,000 (previous year) + $970,000 (new opportunity) = $2,570,000

Total investment = $10,000,000 (previous year) + $1,000,000 (new opportunity) = $11,000,000

ROI = (total income - total investment) / total investment x 100%

ROI = ($2,570,000 - $11,000,000) / $11,000,000 x 100%

ROI = - 70%

This negative ROI suggests that the company would be better off not pursuing the investment opportunity. However, this calculation assumes that the company will otherwise perform the same as last year. If the new investment generates additional income or efficiencies in other areas of the business, the overall ROI could be higher.

Therefore, the best choice is C, 9.7%, as it is the closest to the average ROI for the previous year (9.5%). However, it should be noted that pursuing the investment opportunity may not necessarily result in this ROI and further analysis is needed to make a more informed decision.

Total income = $1,600,000 (previous year) + $970,000 (new opportunity) = $2,570,000

Total investment = $10,000,000 (previous year) + $1,000,000 (new opportunity) = $11,000,000

ROI = (total income - total investment) / total investment x 100%

ROI = ($2,570,000 - $11,000,000) / $11,000,000 x 100%

ROI = - 70%

This negative ROI suggests that the company would be better off not pursuing the investment opportunity. However, this calculation assumes that the company will otherwise perform the same as last year. If the new investment generates additional income or efficiencies in other areas of the business, the overall ROI could be higher.

Therefore, the best choice is C, 9.7%, as it is the closest to the average ROI for the previous year (9.5%). However, it should be noted that pursuing the investment opportunity may not necessarily result in this ROI and further analysis is needed to make a more informed decision.

Learning Objectives

- Master the understanding of operational performance metrics, including net operating income, margin, turnover, and ROI determinations.

Related questions

BR Company Has a Contribution Margin of 9 ...

Nasser Incorporated Reported the Following Results from Last Year's Operations ...

The Following Information Relates to Last Year's Operations at the ...

Given the Following Data: Return on Investment (ROI) Is ...

Chiodini Incorporated Has a $900,000 Investment Opportunity That Involves Sales ...