Asked by Sophia Winner on Jul 09, 2024

Verified

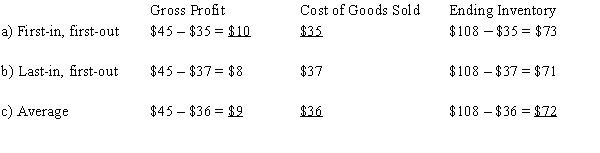

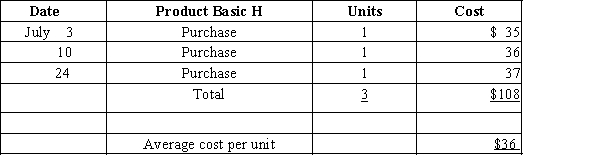

Three identical units of merchandise were purchased during July, as follows:  Assume one unit sells on July 28 for $45.Determine the gross profit, cost of goods sold, and ending inventory on July 31 using (a) first-in, first-out, (b) last-in, first-out, and (c) average cost flow methods.

Assume one unit sells on July 28 for $45.Determine the gross profit, cost of goods sold, and ending inventory on July 31 using (a) first-in, first-out, (b) last-in, first-out, and (c) average cost flow methods.

Average Cost

A method of inventory valuation that calculates the cost of goods sold and ending inventory based on the weighted average cost of all goods available for sale.

First-In, First-Out

An inventory valuation method where the cost of the earliest goods purchased are the first to be recognized in determining cost of goods sold.

Last-In, First-Out

An inventory valuation method where the costs of the most recently acquired items are the first to be expensed.

- Elaborate the cost of goods sold, gross income, and ending inventory through disparate cost flow techniques.

Verified Answer

Learning Objectives

- Elaborate the cost of goods sold, gross income, and ending inventory through disparate cost flow techniques.

Related questions

Beginning Inventory, Purchases, and Sales for an Inventory Item Are ...

Assume That Three Identical Units of Merchandise Were Purchased During ...

The Units of Manganese Plus Available for Sale During the ...

Beginning Inventory, Purchases, and Sales Data for Tennis Rackets Are ...

Beginning Inventory, Purchases, and Sales Data for Widgets Are as ...