Asked by Jailah Armstrong on Jul 09, 2024

Verified

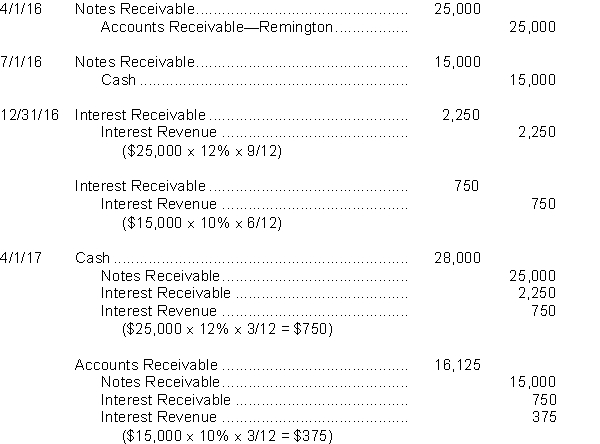

Morton Company had the following select transactions. Apr. \quad 1,2016 \quad Accepted Remington Company's 1-year, 12 % note in \quad \quad \quad \quad \quad \quad \quad \quad settlement of a $ 25,000 account receivable.

July \quad 1,2016 \quad Loaned $15,000 cash to Jenny Green on a 9-month, 10 % \quad \quad \quad \quad \quad \quad \quad note.

Dec. \quad 31,2016 \quad Accrued interest on all notes receivable.

Apr. \quad 1,2017 \quad Received principal plus interest on the Remington note.

Apr. \quad 1,2017 \quad Jenny Green dishonored its note: Morton expects it \quad \quad \quad \quad \quad \quad \quad \quad \quad will eventually collect. Instructions

Prepare journal entries to record the transactions. Morton prepares adjusting entries once a year on December 31.

Accrued Interest

Interest that has been incurred but not yet paid, reflecting money owed on loans or credit extended.

Dishonored Note

A dishonored note is a promissory note that has not been paid upon its maturity date.

Journal Entries

Records of financial transactions in the chronological order by which they occur, entered in the accounting records.

- Generate financial records for activities involving notes receivable, with a focus on the accrual and collection of interest.

Verified Answer

Learning Objectives

- Generate financial records for activities involving notes receivable, with a focus on the accrual and collection of interest.

Related questions

Prepare the Necessary Journal Entries for the Following Transactions for ...

Journalize the Following Transactions of Upton Drugs:July 8Received a $180,000 ...

Journalize the Following Transactions ...

Journalize the Following Transactions in the Accounts of Simmons Company ...

For Each of the Following Notes Receivables Held by Christensen ...