Asked by joseph sciotto on Jul 13, 2024

Verified

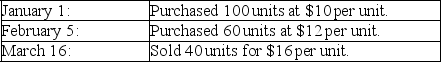

Use the information below to determine the sales revenue,cost of goods sold and gross profit that would be reported for the company related to the March 16 sale assuming the company uses weighted average inventory valuation and a perpetual inventory system.

Weighted Average Inventory Valuation

A method for valuing inventory by calculating the average cost of all inventory items, weighted by the quantities of each item.

Perpetual Inventory System

An accounting method that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.

Sales Revenue

The total income received by a company from its sales of goods or services, before any expenses are subtracted.

- Calculate sales revenue, cost of goods sold, and gross profit using weighted average inventory valuation under a perpetual inventory system.

Verified Answer

Cost of goods sold = 40 * $10.75* = $430

Gross profit = $640 - $430 = $210

*[(100 * $10)+ (60 * $12)]/160 = $10.75

Learning Objectives

- Calculate sales revenue, cost of goods sold, and gross profit using weighted average inventory valuation under a perpetual inventory system.

Related questions

Brutus Corporation, a Newly Formed Corporation, Has the Following Transactions \(@ ...

Assuming That the Company Uses the Perpetual Inventory System, Determine ...

Assuming That the Company Uses the Perpetual Inventory System, Determine ...

FIFO and LIFO Are the Two Most Common Cost Flow ...

Britt Company Uses the Perpetual Inventory System and the LIFO ...