Asked by George Maillard Jr. on Jul 15, 2024

Verified

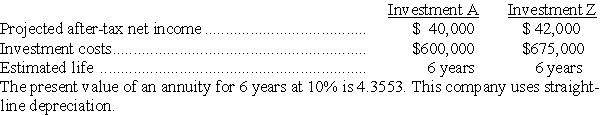

A company has a decision to make between two investment alternatives.The company requires a 10% return on investment.Predicted data is provided below:

Required:

Required:

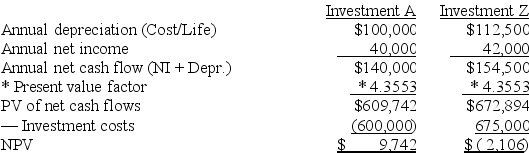

(a)Calculate the net present value for each investment.

(b)Which investment should this company select? Explain.

Net Present Value

A calculation that compares the present value of cash inflows to the present value of cash outflows over a period of time, used in capital budgeting to assess profitability of investments.

Return on Investment

A performance measure used to evaluate the efficiency or profitability of an investment or to compare the efficiency of several different investments.

- Determine the net present value (NPV) of an investment and understand its implications for project selection.

Verified Answer

(b)Select Investment A because it has a positive NPV and it is superior to Investment Z.

(b)Select Investment A because it has a positive NPV and it is superior to Investment Z.

Learning Objectives

- Determine the net present value (NPV) of an investment and understand its implications for project selection.

Related questions

Majestic Theaters Is Considering Investing in Some New Projection Equipment ...

PEI Corp's Management Has Determined That Two Independent Projects Have ...

Merritt Company Is Considering a New Project That Has a ...

The Management of Opray Corporation Is Considering the Purchase of ...

Jojola Corporation Is Investigating Buying a Small Used Aircraft for ...