Asked by Chintan Kothari on Jul 15, 2024

Verified

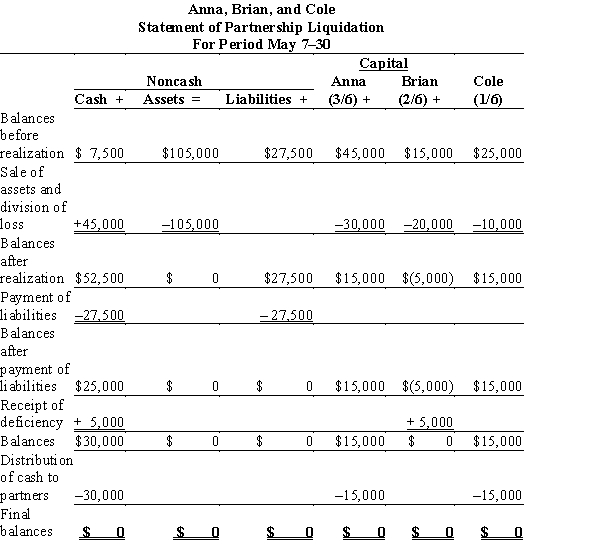

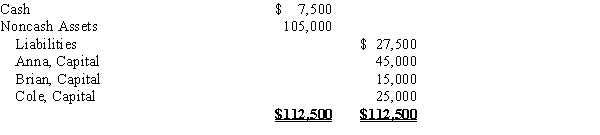

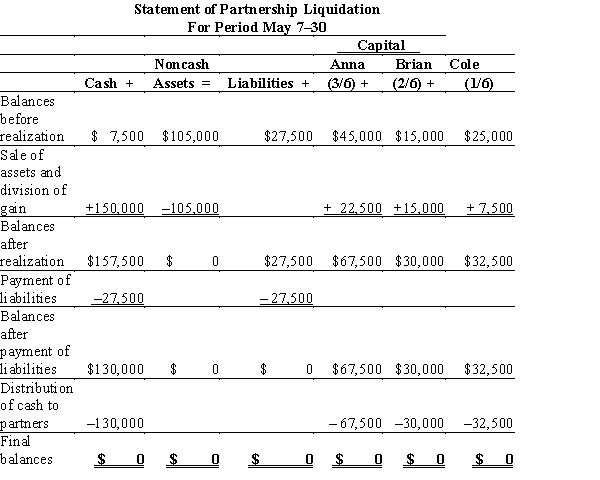

After discontinuing the ordinary business operations and closing the accounts on May 7, the ledger of the partnership of Anna, Brian, and Cole indicated the following:  The partners share net income and losses in the ratio of 3:2:1. Between May 7 and May 30, the noncash assets were sold for $150,000, the liabilities were paid, and the remaining cash was distributed to the partners.

The partners share net income and losses in the ratio of 3:2:1. Between May 7 and May 30, the noncash assets were sold for $150,000, the liabilities were paid, and the remaining cash was distributed to the partners.

(a)Prepare a statement of partnership liquidation.

(b)Assume the same facts as in

(a), except that the noncash assets were sold for $45,000 and any partner with a capital deficiency pays the amount of the deficiency to the partnership. Prepare a statement of partnership liquidation.

Partnership Liquidation

The process of closing a partnership by selling off assets, paying liabilities, and distributing the remaining assets to partners.

Capital Balances

The amount of funds contributed by owners or shareholders, plus retained earnings or net income, less any dividends paid out.

Capital Deficiency

A financial situation where a company's liabilities exceed its assets, indicating potential difficulties in covering its debts.

- Conduct suitable accounting practices when liquidating a partnership and grasp the implications for the capital accounts of the partners.

- Record the accounting entries for the liquidation of a partnership, including handling of capital deficiencies.

Verified Answer

Learning Objectives

- Conduct suitable accounting practices when liquidating a partnership and grasp the implications for the capital accounts of the partners.

- Record the accounting entries for the liquidation of a partnership, including handling of capital deficiencies.

Related questions

Prior to Liquidating Their Partnership, Samuel and Brian Had Capital ...

Prior to Liquidating Their Partnership, Craig and Jenny Had Capital ...

Partners Ken and Macki Each Have a $40,000 Capital Balance ...

In Liquidating a Partnership It Is Necessary to Convert ______________ ...

The HK Partnership Is Liquidated When the Ledger Shows Henson ...

(b)

(b)