Asked by Nguy?n Luân on Jul 16, 2024

Verified

When the raw materials used in production are recorded in transaction (b) above, which of the following entries will be made?

A) $650 in the Materials Quantity Variance column

B) ($650) in the Materials Price Variance column

C) ($650) in the Materials Quantity Variance column

D) $650 in the Materials Price Variance column

Materials Quantity Variance

The deviation found by multiplying the standard cost per unit with the difference in the actual and expected standard volumes of materials used in the production process.

Materials Price Variance

A financial measure used to determine the variation in the cost of raw materials against the pre-defined standard cost.

- Comprehend the financial transactions involved in the procurement of raw materials.

Verified Answer

TB

Terrence BrownJul 23, 2024

Final Answer :

A

Explanation :

The materials price variance is recorded when materials are purchased; the materials quantity variance is recorded when raw materials are used.

Materials quantity variance:

SQ = Actual output × Standard quantity = 24,700 units × 3.8 liters per unit = 93,860 liters

Materials quantity variance = (AQ - SQ)× SP

= (93,760 liters - 93,860 liters)× $6.50 per liter

= (-100 liters)× $6.50 per liter

= $650 F

Favorable variances are entered in the worksheet as positive entries and unfavorable variances as negative entries.

Reference: APP10B-Ref10

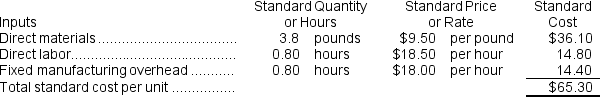

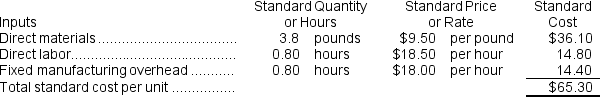

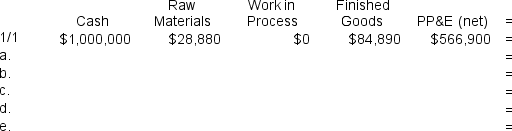

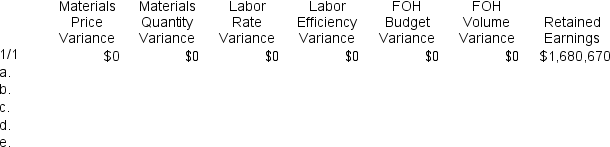

Robins Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows: The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.

During the year, the company completed the following transactions:

a.Purchased 134,700 pounds of raw material at a price of $9.10 per pound.

b.Used 122,080 pounds of the raw material to produce 32,100 units of work in process.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 26,680 hours at an average cost of $17.20 per hour.

d.Applied fixed overhead to the 32,100 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $378,400.Of this total, $297,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $81,000 related to depreciation of manufacturing equipment.

e.Completed and transferred 32,100 units from work in process to finished goods.

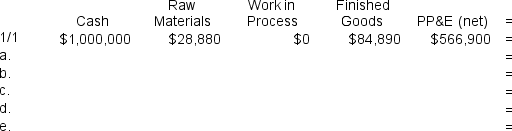

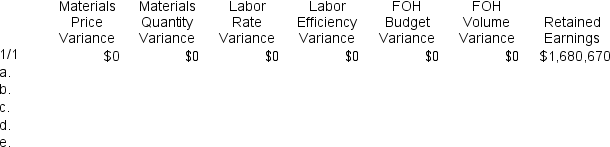

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page.The beginning balances in each of the accounts have been given.PP&E (net)stands for Property, Plant, and Equipment net of depreciation.

Materials quantity variance:

SQ = Actual output × Standard quantity = 24,700 units × 3.8 liters per unit = 93,860 liters

Materials quantity variance = (AQ - SQ)× SP

= (93,760 liters - 93,860 liters)× $6.50 per liter

= (-100 liters)× $6.50 per liter

= $650 F

Favorable variances are entered in the worksheet as positive entries and unfavorable variances as negative entries.

Reference: APP10B-Ref10

Robins Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.During the year, the company completed the following transactions:

a.Purchased 134,700 pounds of raw material at a price of $9.10 per pound.

b.Used 122,080 pounds of the raw material to produce 32,100 units of work in process.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 26,680 hours at an average cost of $17.20 per hour.

d.Applied fixed overhead to the 32,100 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $378,400.Of this total, $297,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $81,000 related to depreciation of manufacturing equipment.

e.Completed and transferred 32,100 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page.The beginning balances in each of the accounts have been given.PP&E (net)stands for Property, Plant, and Equipment net of depreciation.

Learning Objectives

- Comprehend the financial transactions involved in the procurement of raw materials.

Related questions

The Ending Balance in the PP&E (Net)account Will Be Closest ...

When Recording the Raw Materials Purchases in Transaction (A)above, the ...

What Journal Entry Should Andrew Use to Account for Direct ...

Vinall Corporation Makes One Product and Has Provided the Following ...

Mumbower Corporation Makes One Product and Has Provided the Following ...