Asked by Gisselle Leyva on Jul 20, 2024

Verified

Brislin Humphreys and Watkins share income and losses in a ratio of 3:2:5 respectively. The capital account balances of the partners are as follows:

Instructions

Prepare the journal entry on the books of the partnership to record the withdrawal of Watkins under the following independent circumstances:

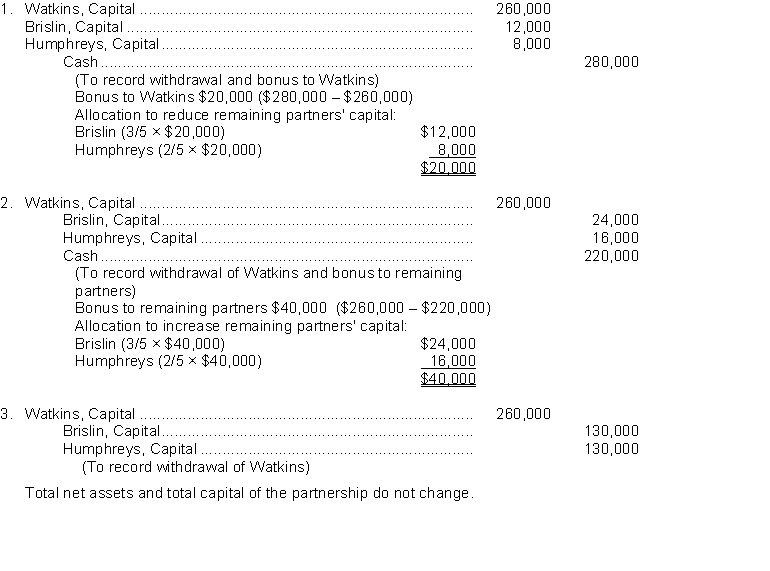

1. The partners agree that Watkins should be paid $280000 by the partnership for his interest.

2. The partners agree that Watkins should be paid $220000 by the partnership for his interest.

3. Brislin agrees to pay Watkins $180000 for one-half of his capital interest and Heller agrees to pay Watkins $180000 for one-half of his capital interest in a personal transaction among the partners.

Withdrawal

The act of removing funds from a bank account, or taking capital out of a business by an owner for personal use.

Capital Interest

Interest attributable to the ownership or investment in a business entity or property, often reflecting the cost of financing the entity's assets.

Partnership Assets

Resources owned by a partnership that are used in the operation of the business and are subject to division among partners according to the partnership agreement.

- Understand the processes and accounting treatment for partner withdrawals and their influence on the partnership's financial statements.

Verified Answer

Learning Objectives

- Understand the processes and accounting treatment for partner withdrawals and their influence on the partnership's financial statements.

Related questions

194 Elam Kamins and Rubio Have Capital Balances of $150000 ...

If the Retiring Partner's Interest Is Sold to One of ...

Nate Is Investing in a Partnership with Deidre ...

Regardless of the Partners' Consent or Agreement, the Voluntary Dissociation ...

Dissociation Occurs When a Partner Ceases to Be Associated in ...