Asked by Kaitlyn Simon on Jul 22, 2024

Verified

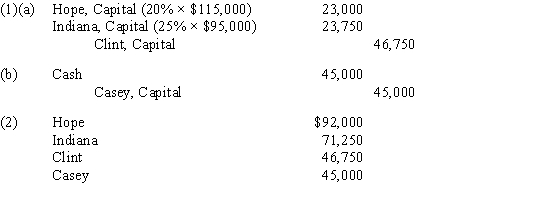

The capital accounts of Hope and Indiana have balances of $115,000 and $95,000, respectively. Clint and Casey are to be admitted to the partnership. Clint buys one-fifth of Hope's interest for $30,000 and one-fourth of Indiana's interest for $20,000. Casey contributes $45,000 cash to the partnership, for which he is to receive an ownership equity of $45,000.Required

(1) Journalize the entries to record the admission of

(a) Clint and

(b) Casey.

(2) What are the capital balances of each partner after the admission of the new partners?

Capital Accounts

Accounts that track the equity ownership of partners or shareholders in a business, reflecting contributions, withdrawals, and the share of profits or losses.

Ownership Equity

Refers to the residual interest in the assets of an entity after deducting liabilities, representing the owner's claim on the business.

Capital Balances

The amount of equity each partner or owner has in a business, reflecting contributions, withdrawals, and their share of profits or losses.

- Engage in journalizing procedures for the onboarding of a new partner into a partnership framework.

- Investigate the modifications made to the capital account after assets have been revalued and new partners are admitted.

- Investigate the repercussions of modifications in partnership arrangements on the equities and capital balances.

Verified Answer

Learning Objectives

- Engage in journalizing procedures for the onboarding of a new partner into a partnership framework.

- Investigate the modifications made to the capital account after assets have been revalued and new partners are admitted.

- Investigate the repercussions of modifications in partnership arrangements on the equities and capital balances.

Related questions

Kala and Leah, Partners in Best Designs, Have Capital Balances ...

Brad Simmons, Sole Proprietor of a Hardware Business, Decides to ...

Gentry, Sole Proprietor of a Hardware Business, Decides to Form ...

Watson Purchased One-Half of Dalton's Interest in the Patton and ...

If a New Partner Is to Be Admitted to a ...