Asked by Jesica Alarcon on Jul 27, 2024

Verified

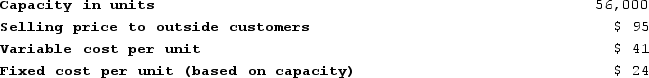

Rohrer Products, Incorporated has a Motor Division that manufactures and sells a number of products, including a standard motor that could be used by another division in the company, the Automotive Division, in one of its products. Data concerning that motor appear below:  The Automotive Division is currently purchasing 10,000 of these motors per year from an overseas supplier at a cost of $88 per motor. Assume that the Motor Division has enough idle capacity to handle all of the Automotive Division's needs. What should be the minimum acceptable transfer price for the motors from the standpoint of the Motor Division?

The Automotive Division is currently purchasing 10,000 of these motors per year from an overseas supplier at a cost of $88 per motor. Assume that the Motor Division has enough idle capacity to handle all of the Automotive Division's needs. What should be the minimum acceptable transfer price for the motors from the standpoint of the Motor Division?

A) $65 per unit

B) $88 per unit

C) $41 per unit

D) $95 per unit

Transfer Price

The cost at which various units within the same corporation sell goods and services to each other.

Idle Capacity

The unused portion of a company's production capacity, where resources such as space, labor, or equipment are underutilized.

- Calculate the minimum acceptable transfer price from a division's standpoint.

Verified Answer

JG

Jazmín GómesJul 30, 2024

Final Answer :

C

Explanation :

The minimum acceptable transfer price for the Motor Division is the variable cost per unit plus opportunity cost. Variable cost per unit includes direct materials, direct labor, and variable overhead, but does not include fixed overhead.

However, the question does not provide information on the variable cost per unit. Therefore, we need to use the market price of $88 per unit as a starting point and subtract from it the opportunity cost.

The opportunity cost is the benefit forgone by not selling the motors to the overseas supplier for $88 per unit. Therefore, the opportunity cost per unit is $88 - $0 = $88.

Thus, the minimum acceptable transfer price from the Motor Division's standpoint is:

Minimum acceptable transfer price = Variable cost per unit + Opportunity cost per unit

Minimum acceptable transfer price = Variable cost per unit + $88

We do not know the variable cost per unit, but we know that the minimum acceptable transfer price from the Motor Division's standpoint must be less than $88 per unit. Therefore, the only answer choice that is less than $88 per unit is C, $41 per unit. Thus, C is the best choice.

However, the question does not provide information on the variable cost per unit. Therefore, we need to use the market price of $88 per unit as a starting point and subtract from it the opportunity cost.

The opportunity cost is the benefit forgone by not selling the motors to the overseas supplier for $88 per unit. Therefore, the opportunity cost per unit is $88 - $0 = $88.

Thus, the minimum acceptable transfer price from the Motor Division's standpoint is:

Minimum acceptable transfer price = Variable cost per unit + Opportunity cost per unit

Minimum acceptable transfer price = Variable cost per unit + $88

We do not know the variable cost per unit, but we know that the minimum acceptable transfer price from the Motor Division's standpoint must be less than $88 per unit. Therefore, the only answer choice that is less than $88 per unit is C, $41 per unit. Thus, C is the best choice.

Learning Objectives

- Calculate the minimum acceptable transfer price from a division's standpoint.

Related questions

Brull Products, Incorporated, Has a Sensor Division That Manufactures and ...

Delemos Products, Incorporated Has a Transmitter Division That Manufactures and ...

Stokan Products, Incorporated, Has a Antennae Division That Manufactures and ...

Using the Formula in the Text, If the Lowest Acceptable ...

The Southern Division of Barstol Company Makes and Sells a ...