Asked by Allie Spolsdoff on Jun 25, 2024

Verified

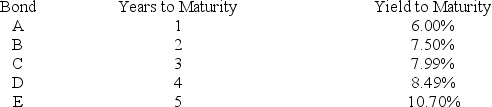

$1,000 par value zero-coupon bonds (ignore liquidity premiums)

One year from now bond C should sell for ________ (to the nearest dollar) .

A) $857

B) $894

C) $835

D) $821

Zero-Coupon Bonds

Bonds that do not pay interest during their lifetime but are sold at a discount to their face value, which is paid at maturity.

- Ascertain the yield to maturity and appreciate its significance.

Verified Answer

JC

jeniffer ChavezJun 28, 2024

Final Answer :

B

Explanation :

1.07993 = 1.06(1 + 1F3)2

1.2593621/1.06 = (1 + 1F3)2

1F3 = 11.81%

Price of bond C in 1 year = 1,000/1.1181 = 894.37

1.2593621/1.06 = (1 + 1F3)2

1F3 = 11.81%

Price of bond C in 1 year = 1,000/1.1181 = 894.37

Learning Objectives

- Ascertain the yield to maturity and appreciate its significance.