Asked by Maddi Coones on Jul 05, 2024

Verified

A callable bond pays annual interest of $60, has a par value of $1,000, matures in 20 years but is callable in 10 years at a price of $1,100, and has a value today of $1055.84. The yield to call on this bond is ________.

A) 6%

B) 6.58%

C) 7.2%

D) 8%

Callable Bond

A type of bond that gives the issuer the right to redeem the bond at a predetermined price before its maturity date.

Yield To Call

The rate of return anticipated on a bond if it is held until the call date, before the bond's maturity date.

Par Value

The face value of a bond or stock, representing the amount the issuer will return to the holder at maturity.

- Master the concept of yield to call and its calculations.

Verified Answer

KM

Karan MohanJul 11, 2024

Final Answer :

A

Explanation :

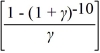

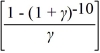

1,055.84 = 60  +

+  ; r = 6.00%

; r = 6.00%

Calculator entries are N = 10, PV = −1,055.84, PMT = 60, FV = 1,100, CPT I/Y → 6

+

+  ; r = 6.00%

; r = 6.00%Calculator entries are N = 10, PV = −1,055.84, PMT = 60, FV = 1,100, CPT I/Y → 6

Learning Objectives

- Master the concept of yield to call and its calculations.