Asked by Tanisha Anderson on May 03, 2024

Verified

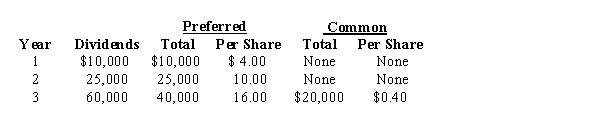

A company had stock outstanding as follows during each of its first three years of operations: 2,500 shares of 10%, $100 par, cumulative preferred stock and 50,000 shares of $10 par common stock. The amounts distributed as dividends are presented below. Determine the total and per-share dividends for each class of stock for each year by completing the schedule.

Cumulative Preferred Stock

A type of preferred stock that accrues dividends in the event that any dividends are missed, ensuring that preferred shareholders are paid both missed and current dividends before any are paid to common shareholders.

Common Stock

A type of equity security that represents ownership in a corporation, with voting rights and potential for dividends.

Dividends

Distributions made to shareholders by a company, often from its earnings.

- Gain insight into the calculation of dividends per share for preferred and common stocks across diverse scenarios.

Verified Answer

ZK

Learning Objectives

- Gain insight into the calculation of dividends per share for preferred and common stocks across diverse scenarios.