Asked by Julio Cesar Meirelles on May 09, 2024

Verified

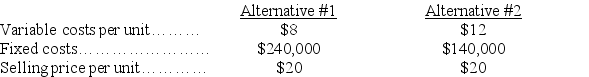

A company is looking into two alternative methods of producing its product.The following information about the two alternatives is available.If the company's expected sales volume is 35,000 units,which alternative should be selected?Prepare forecasted contribution margin income statements and compute the degree of operating leverage to assess the alternatives.

Degree of Operating Leverage

A financial ratio that measures the percentage change in operating income in response to a percentage change in sales.

Forecasted Contribution Margin

An estimated metric that indicates the difference between sales revenue and variable costs of goods sold, used to predict the profitability of sales.

- Analyze the influence of price adjustments, promotional activities, and variations in expenses on profitability via scenario evaluation.

- Apply the principle of operating leverage to evaluate fluctuations in sales and profitability.

Verified Answer

JE

Jocelyn EslavaMay 11, 2024

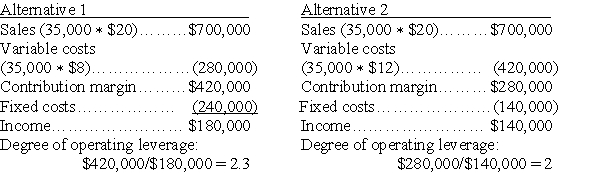

Final Answer :  Alternative 1 provides the higher income.In addition,it has a higher degree of operating leverage.This means that for every 1% of increase in sales,income before tax should increase by 2.3% for alternative 1,rather than 2% for alternative 2.Therefore,alternative 1 should be selected.

Alternative 1 provides the higher income.In addition,it has a higher degree of operating leverage.This means that for every 1% of increase in sales,income before tax should increase by 2.3% for alternative 1,rather than 2% for alternative 2.Therefore,alternative 1 should be selected.

Alternative 1 provides the higher income.In addition,it has a higher degree of operating leverage.This means that for every 1% of increase in sales,income before tax should increase by 2.3% for alternative 1,rather than 2% for alternative 2.Therefore,alternative 1 should be selected.

Alternative 1 provides the higher income.In addition,it has a higher degree of operating leverage.This means that for every 1% of increase in sales,income before tax should increase by 2.3% for alternative 1,rather than 2% for alternative 2.Therefore,alternative 1 should be selected.

Learning Objectives

- Analyze the influence of price adjustments, promotional activities, and variations in expenses on profitability via scenario evaluation.

- Apply the principle of operating leverage to evaluate fluctuations in sales and profitability.