Asked by Jeanette Retana on Apr 29, 2024

Verified

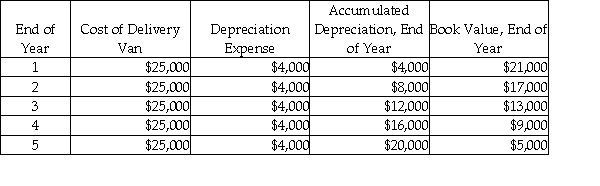

A company purchased a new delivery van on January 1, 2012 for $25,000. The company expects to use the van for 5 years and then sell it for $5,000. Complete the following depreciation table assuming straight-line depreciation:

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual amounts.

Depreciation Table

A schedule that shows the depreciation expense, accumulated depreciation, and book value of each asset over its useful life.

Delivery Van

A Delivery Van is a type of vehicle used by businesses for the transportation of goods, products, or materials directly to customers or between locations.

- Ascertain depreciation charges through the application of the units-of-production method and different strategies.

Verified Answer

AC

Learning Objectives

- Ascertain depreciation charges through the application of the units-of-production method and different strategies.